Top Industry Leaders in the Hydrogen Electrolyzer Market

*Disclaimer: List of key companies in no particular order

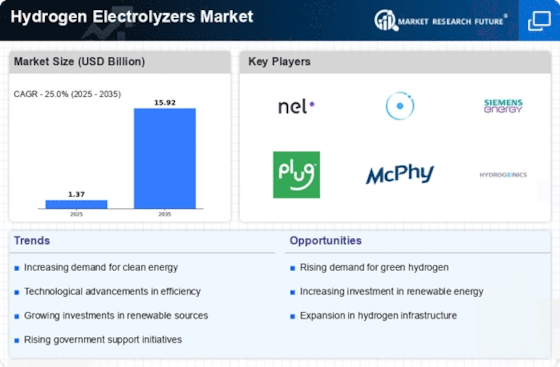

Top listed global companies in the hydrogen electrolyzers industry are:

Siemens Energy

Nel Hydrogen

Bloom Energy

Giner Inc.

Plug Power

McPhy

Pure Energy Centre

Idroenergy

Star Gate Hydrogen

Enapter

Bridging the Gap by Exploring Top Leaders Competitive Landscape of the hydrogen electrolyzers Market

The hydrogen electrolyzer market, fueled by the surging demand for clean energy solutions, is witnessing a dynamic and rapidly evolving competitive landscape. As governments and industries prioritize decarbonization, electrolyzers, responsible for splitting water into hydrogen and oxygen, have become strategic assets in the transition to a hydrogen economy.

Key Player Strategies:

Established names: Traditional energy players like Siemens, Thyssenkrupp, and NEL Hydrogen are leveraging their experience in large-scale engineering and existing supply chains to secure major project contracts and partnerships. They focus on scaling up production, cost reduction, and optimizing alkaline and PEM electrolyzer technologies.

New entrants: Innovative startups like McPhy Energy, Enapter, and SunHydrogen are pushing boundaries with modular designs, high-efficiency stacks, and exploring next-generation technologies like anion exchange membrane (AEM) electrolyzers. Their agility and focus on specific niches allow them to carve out profitable segments.

Collaborations and acquisitions: Strategic partnerships and acquisitions are shaping the market. ITM Power's recent acquisition of electrolysis specialist㎥Green Hydrogen Systems strengthens its portfolio and geographic reach. Meanwhile, collaborations like Shell and Cummins' joint venture for PEM electrolyzer production aim to combine expertise and accelerate scale-up.

Factors for Market Share Analysis:

Technology leadership: Technological advancements dictate efficiency, capacity, and cost. Players excelling in specific technologies, like McPhy in AEM electrolyzers, gain advantage in niche markets.

Manufacturing and cost competitiveness: Large-scale production capabilities and cost-effective materials sourcing enable players like NEL Hydrogen to offer competitive pricing and win larger project bids.

Project execution and after-sales service: A proven track record in delivering projects on time and budget, alongside reliable after-sales service, builds trust and long-term partnerships with clients.

Regional focus and government policies: Companies with strong regional presence and alignment with supportive government policies, like China's focus on PEM electrolyzers, gain market share in specific regions.

New and Emerging Trends:

Electrolyzer stack innovation: Companies are actively researching and developing improved materials and stack designs to boost efficiency, durability, and reduce costs. For example, Enapter's AEM electrolyzers offer high efficiency and compact modularity.

Renewable energy integration: Integrating electrolyzers directly with renewable energy sources like solar and wind farms, as in ITM Power's Green Hydrogen projects, optimizes production and grid balancing.

Electrolyzer standardization and modularity: Standardizing components and modular designs, like Cummins' HyLyzer product line, simplifies manufacturing, reduces costs, and enables faster deployment.

Green hydrogen production: Focus is shifting towards producing hydrogen using renewable electricity (green hydrogen) to create a truly carbon-neutral value chain.

Overall Competitive Scenario:

The hydrogen electrolyzer market is characterized by intense competition amidst rapid technological advancements. Established players hold the current market share lead, but innovative startups are carving out niches with disruptive technologies. Collaborations and acquisitions are accelerating consolidation and growth.

Success factors in this dynamic landscape include a blend of technological leadership, competitive manufacturing, strong project execution, and strategic partnerships. Adapting to emerging trends like renewable energy integration, green hydrogen production, and standardized modular designs will be crucial for capturing future market share.

As the hydrogen economy takes shape, the global electrolyzer market promises to be a high-growth, high-stakes arena, attracting further investments, innovations, and fierce competition. Only those players who adapt and excel across the entire value chain can secure their leadership in this burgeoning clean energy frontier.

This analysis provides a snapshot of the current competitive landscape, but the dynamics are constantly evolving. Staying informed about the latest trends, strategies, and technological advancements will be key for any player to navigate and thrive in this exciting market.

Latest Company Updates:

Siemens Energy:

- October 26, 2023: Siemens Energy and Shell signed a Memorandum of Understanding (MoU) to collaborate on the development and deployment of large-scale green hydrogen projects in Europe. (Source: Siemens Energy press release)

Nel Hydrogen:

- January 19, 2024: Nel Hydrogen announced a partnership with Orsted to supply a 20 MW PEM electrolyzer for a green hydrogen production facility in Denmark. (Source: Nel Hydrogen press release)

Bloom Energy:

- May 23, 2023: Bloom Energy began generating hydrogen from the world's largest solid oxide electrolyzer installation at NASA's Ames Research Center. (Source: Bloom Energy press release)

Giner Inc.:

- January 18, 2024: Giner Inc. announced the successful completion of a 1 MW alkaline electrolyzer demonstration project for the U.S. Department of Energy. (Source: Giner Inc. press release)