Increased Focus on Energy Efficiency

The Global Hydraulic Equipment Market Industry is witnessing a heightened emphasis on energy efficiency, driven by regulatory frameworks and sustainability initiatives. Industries are increasingly adopting hydraulic systems that minimize energy consumption while maximizing output. This shift not only aligns with global environmental goals but also offers cost savings for businesses. Hydraulic equipment manufacturers are responding by developing energy-efficient solutions that comply with stringent regulations. As a result, the market is likely to see a significant uptick in demand for such products, contributing to the overall growth of the industry. This trend reflects a broader commitment to sustainable practices across various sectors.

Expansion of Agricultural Mechanization

The Global Hydraulic Equipment Market Industry is significantly influenced by the expansion of agricultural mechanization. As farmers seek to enhance productivity and efficiency, the adoption of hydraulic systems in agricultural machinery is on the rise. Equipment such as tractors and harvesters increasingly rely on hydraulic technology to perform complex tasks with precision. This trend is particularly evident in regions where agriculture is a primary economic driver. The integration of hydraulic systems not only improves operational efficiency but also supports sustainable farming practices. As the agricultural sector continues to evolve, the demand for hydraulic equipment is expected to grow, further bolstering the industry.

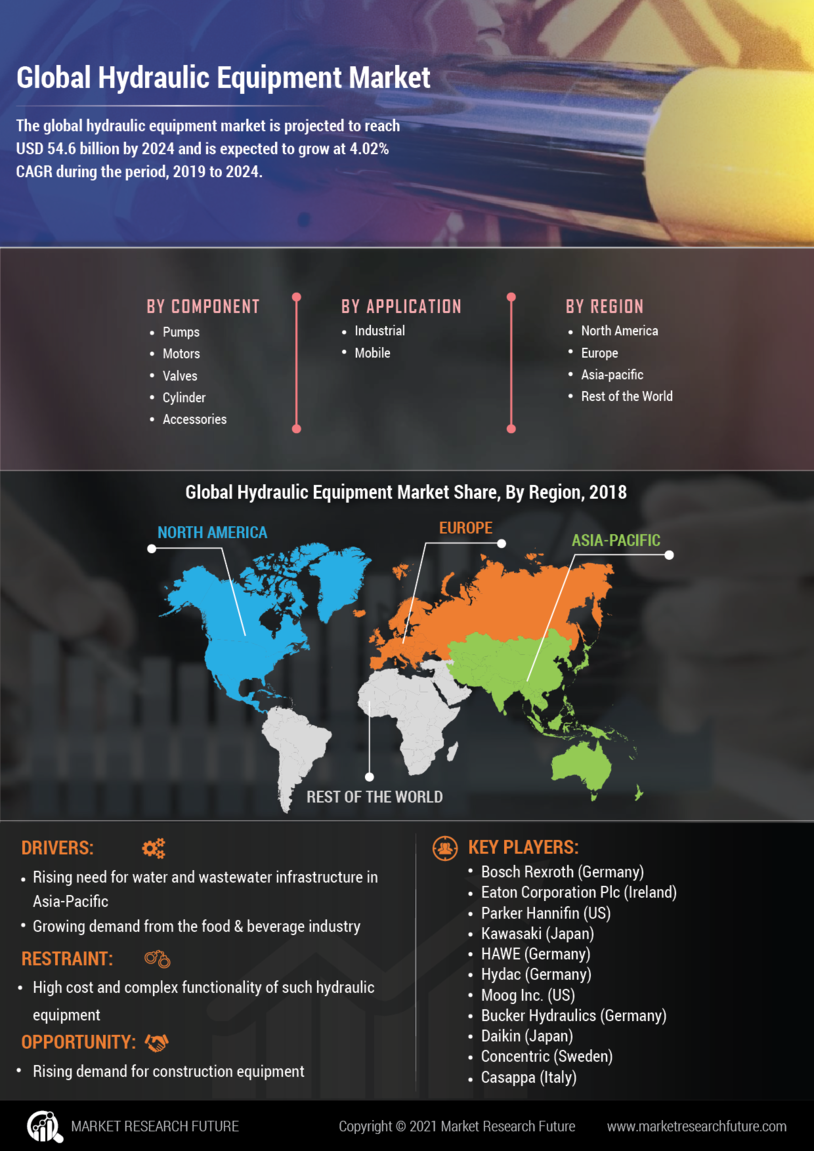

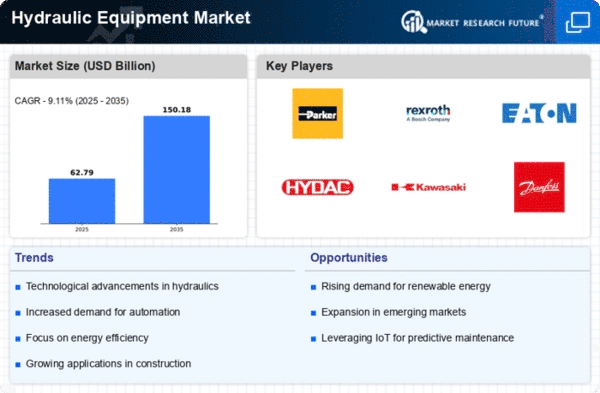

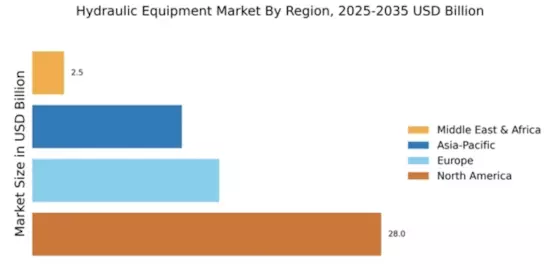

Rising Demand for Construction Equipment

The Global Hydraulic Equipment Market Industry is experiencing a surge in demand driven by the booming construction sector. As urbanization accelerates, infrastructure projects are proliferating, necessitating advanced hydraulic systems for machinery such as excavators and cranes. In 2024, the market is projected to reach 57.5 USD Billion, reflecting the industry's response to the increasing need for efficient construction solutions. This growth trajectory is expected to continue, with the market potentially expanding to 150.2 USD Billion by 2035, indicating a robust compound annual growth rate of 9.11% from 2025 to 2035. Such dynamics underscore the critical role of hydraulic equipment in modern construction practices.

Growing Demand from the Manufacturing Sector

The Global Hydraulic Equipment Market Industry is benefiting from the escalating demand from the manufacturing sector. As industries strive for automation and increased production capabilities, hydraulic systems are becoming integral to manufacturing processes. These systems facilitate the operation of machinery, enhancing productivity and precision. The ongoing trend towards automation is likely to drive further investments in hydraulic technology, as manufacturers seek to optimize their operations. This demand is expected to contribute significantly to the market's growth, with projections indicating a robust expansion trajectory. The manufacturing sector's reliance on hydraulic equipment underscores its importance in driving industrial advancements.

Technological Advancements in Hydraulic Systems

Technological innovation plays a pivotal role in shaping the Global Hydraulic Equipment Market Industry. The introduction of smart hydraulic systems, which integrate IoT and automation, enhances operational efficiency and reduces downtime. These advancements allow for real-time monitoring and predictive maintenance, thereby optimizing performance. As industries increasingly adopt these technologies, the demand for sophisticated hydraulic solutions is likely to rise. The ongoing evolution of hydraulic components, such as pumps and valves, further supports this trend, enabling manufacturers to offer more reliable and efficient products. Consequently, the market is poised for substantial growth as businesses seek to leverage these innovations.