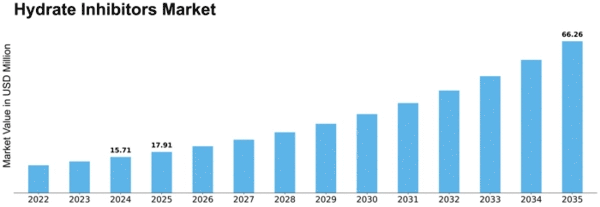

Hydrate Inhibitors Size

Hydrate Inhibitors Market Growth Projections and Opportunities

Various factors affect the dynamics and growth of the Hydrate Inhibitors Market. Hydrate inhibitors are in increasing demand in the oil and gas industry, where they help prevent gas hydrates from forming, which is fundamental. When water combines with natural gas under specific temperature and pressure conditions, it produces gas hydrates, which are a challenge to oil and gas extraction and transportation. The global hydrate inhibitors market was valued at USD 12,772.7 million in 2021 and is projected to reach USD 21,561.8 million by 2030 at a CAGR of 6.27%. This means that offshore oil and gas exploration activities can also cause an expansion in the hydrate inhibitors market. However, this is not the case for such environments since their operations rely heavily on subsea pipelines and facilities that endure harsh conditions; hence, hydrate formation prevention is essential for the efficiency of operations and protection. In addition, the expansion of the natural gas sector also affects the performance of this industry by using these chemicals to deal with challenges arising out of hydrates during their processing or transportation processes. With global demand for natural gases rising, particularly for power generation purposes as well as industrial usage, there is a greater need for effective inhibition against hydrates as such forms become more common due to increased extraction activity all over the world. Additionally, technology advancements have shaped the global market by formulation advances among other innovations in its product line-up, such as CIDRA's Research & Development program leading new inhibitor compositions engineered specifically to offer better compatibility with different compositions of gases used. These high-performance, cost-effective, environmentally friendly inhibitions will reduce operational costs. Novel emerging application technologies plus chemistries meant to address shifting requirements within this sector have improved competitiveness vis-à-vis related firms worldwide. The geographical distribution of oil and gas activities, including offshore exploration and production, significantly impacts the hydrate inhibitors market. Rich offshore reserves areas like Gulf Mexico, North Sea, and Offshore Asia-Pacific, among others, get more of the hydrate inhibitors demands. However, volatility in oil and gas prices, environmental concerns, and customized solutions are some of the challenges that can impact the hydrate inhibitors market. Commodity prices greatly influence the commercial viability of oil and gas projects, which affects investment decisions as well as demand for hydrate inhibitors. Environmental considerations such as environmentally friendly formulations of hydrate inhibitor chemicals are also important since these industries have to meet sustainability needs. Additionally, different compositions of natural gases coupled with varying operation conditions necessitate specialized treatments for various applications.

Leave a Comment