Rising Fuel Efficiency Standards

The Hybrid System in Automotive Market is experiencing a notable shift due to the increasing fuel efficiency standards imposed by various governments. These regulations aim to reduce greenhouse gas emissions and promote sustainable transportation. As a result, automakers are compelled to innovate and integrate hybrid systems into their vehicles to comply with these standards. For instance, the Corporate Average Fuel Economy (CAFE) standards in the United States have set ambitious targets for fuel efficiency, which has led to a surge in hybrid vehicle production. This regulatory pressure not only drives manufacturers to adopt hybrid technologies but also encourages consumers to consider hybrid vehicles as a viable option, thereby expanding the market.

Government Incentives and Subsidies

The Hybrid System in Automotive Market benefits significantly from government incentives and subsidies aimed at promoting the adoption of hybrid vehicles. Many countries offer tax credits, rebates, and other financial incentives to consumers who purchase hybrid cars, making them more affordable. For instance, in several regions, buyers of hybrid vehicles can receive substantial tax deductions, which can lower the overall cost of ownership. These incentives not only encourage consumers to choose hybrids over conventional vehicles but also stimulate manufacturers to increase their hybrid offerings. As long as these supportive policies remain in place, the hybrid market is expected to thrive.

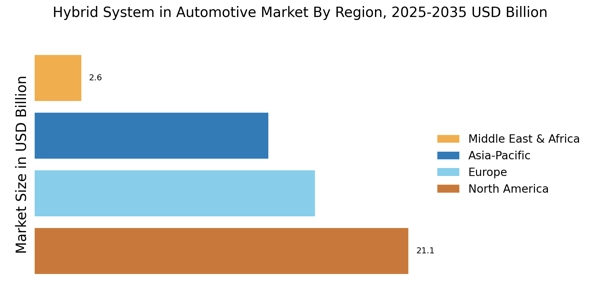

Growing Urbanization and Traffic Congestion

Urbanization and the resulting traffic congestion are pivotal factors influencing the Hybrid System in Automotive Market. As cities expand and populations grow, the demand for efficient and environmentally friendly transportation solutions becomes more pressing. Hybrid vehicles, with their ability to operate efficiently in stop-and-go traffic, present an attractive option for urban commuters. Moreover, many urban areas are implementing low-emission zones, further incentivizing the use of hybrid vehicles. This trend suggests that as urbanization continues, the hybrid market will likely see increased adoption, driven by the need for sustainable urban mobility solutions.

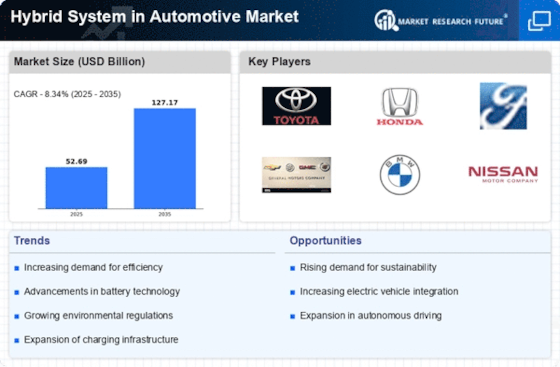

Technological Innovations in Hybrid Systems

Technological advancements play a crucial role in the Hybrid System in Automotive Market. Innovations in battery technology, electric motors, and energy management systems have significantly enhanced the performance and efficiency of hybrid vehicles. For example, the development of lithium-ion batteries has improved energy density and reduced charging times, making hybrids more appealing to consumers. Furthermore, advancements in regenerative braking systems allow for better energy recovery, thus increasing overall vehicle efficiency. As these technologies continue to evolve, they are likely to attract a broader consumer base, thereby propelling the growth of the hybrid market.

Increasing Consumer Awareness of Environmental Issues

Consumer awareness regarding environmental sustainability is a driving force in the Hybrid System in Automotive Market. As individuals become more informed about the impact of traditional vehicles on climate change, there is a growing preference for eco-friendly alternatives. Surveys indicate that a significant percentage of consumers are willing to pay a premium for vehicles that offer lower emissions and better fuel economy. This shift in consumer behavior is prompting automakers to invest more in hybrid technologies, as they seek to meet the demand for greener vehicles. Consequently, the hybrid market is likely to expand as more consumers prioritize sustainability in their purchasing decisions.