Government Incentives and Support

Government incentives and support are crucial drivers for the Hybrid Construction Equipment Market. Various governments are implementing policies that promote the use of hybrid and electric construction equipment as part of their broader environmental strategies. These initiatives often include tax breaks, grants, and subsidies aimed at encouraging companies to invest in cleaner technologies. For example, some regions have introduced programs that provide financial assistance for the purchase of hybrid equipment, thereby reducing the initial investment burden on construction firms. Such supportive measures are expected to accelerate the transition towards hybrid solutions, fostering a more sustainable construction landscape.

Technological Advancements in Equipment

Technological advancements play a pivotal role in shaping the Hybrid Construction Equipment Market. Innovations such as improved battery technology, enhanced fuel efficiency, and advanced control systems are revolutionizing the capabilities of hybrid equipment. These advancements not only increase operational efficiency but also reduce maintenance costs, making hybrid solutions more attractive to construction firms. For instance, the integration of IoT and AI technologies allows for real-time monitoring and predictive maintenance, further enhancing the performance of hybrid equipment. As these technologies continue to evolve, they are likely to drive the adoption of hybrid solutions, positioning the industry for substantial growth in the coming years.

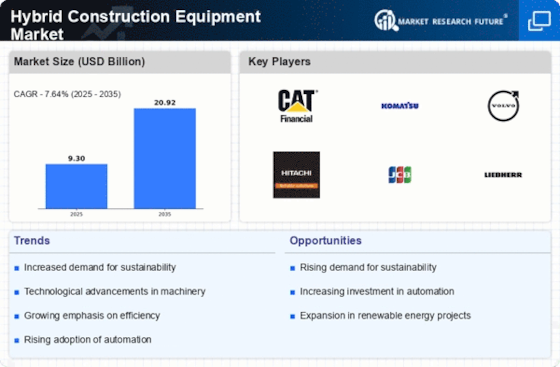

Rising Demand for Eco-Friendly Solutions

The Hybrid Construction Equipment Market is experiencing a notable surge in demand for eco-friendly solutions. As environmental concerns escalate, construction companies are increasingly seeking equipment that minimizes carbon emissions and fuel consumption. This shift is driven by both regulatory pressures and a growing awareness of sustainability among consumers. In fact, the hybrid construction equipment segment is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This trend indicates a significant transformation in the industry, as companies strive to align their operations with sustainable practices. Consequently, manufacturers are investing in research and development to create more efficient hybrid models that meet these evolving demands.

Enhanced Operational Efficiency and Cost Savings

Enhanced operational efficiency and cost savings are key motivators for the adoption of hybrid solutions in the Hybrid Construction Equipment Market. Hybrid equipment typically offers lower fuel consumption and reduced emissions, translating into significant cost savings for construction firms. Additionally, the ability to operate in various modes allows for greater flexibility on job sites, optimizing performance based on specific project requirements. As construction companies face increasing pressure to manage costs while maintaining productivity, the appeal of hybrid equipment becomes more pronounced. This trend suggests that the hybrid construction equipment sector is poised for growth as firms recognize the long-term financial benefits associated with these technologies.

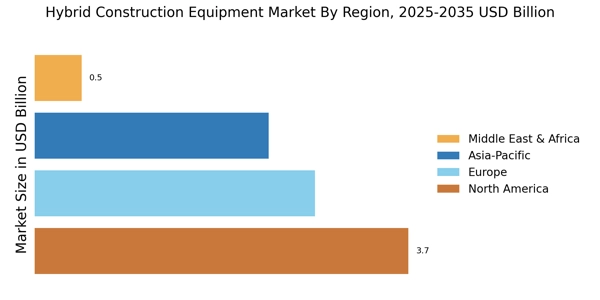

Increasing Urbanization and Infrastructure Development

The Hybrid Construction Equipment Market is significantly influenced by the trends of increasing urbanization and infrastructure development. As urban areas expand, the demand for efficient construction equipment rises. Hybrid construction equipment offers a viable solution to meet this demand while adhering to environmental standards. The construction sector is projected to grow steadily, with investments in infrastructure expected to reach trillions of dollars over the next decade. This growth presents a substantial opportunity for hybrid equipment manufacturers, as construction companies seek to enhance productivity while minimizing their environmental footprint. The intersection of urbanization and hybrid technology is likely to shape the future of construction.