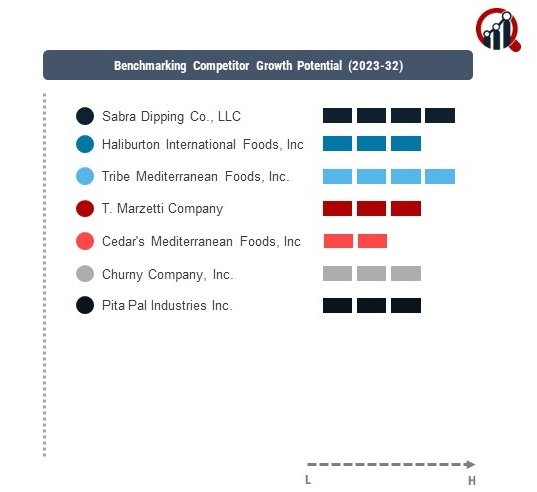

Top Industry Leaders in the Hummus Market

Strategies Adopted by Hummus Key Players

The Hummus market, a significant segment within the global food industry, is characterized by a competitive landscape shaped by factors such as the increasing popularity of plant-based diets, the growing consumer awareness of healthy and flavorful snack options, and the diverse flavor innovations within the hummus category. As of 2023, key players strategically position themselves in this competitive environment, implementing various strategies to maintain or enhance their market share.

Key players in the Hummus market deploy a range of strategies to remain competitive. Continuous innovation in hummus flavors, formulations, and packaging is a central strategy. Companies invest in research and development to create hummus products that cater to diverse consumer preferences, including exotic flavors, organic and clean-label options, and convenient packaging formats. Strategic partnerships with retailers, restaurants, and other food service providers contribute to expanding the market reach and product visibility of hummus. Marketing efforts often focus on brand positioning, emphasizing the quality, authenticity, and nutritional benefits of their hummus offerings.

Market Share Analysis:

Market share analysis in the Hummus market is influenced by several factors, including brand recognition, product quality, pricing strategies, and distribution efficiency. Companies with strong brand equity and a reputation for producing high-quality hummus tend to secure a larger market share. Pricing strategies that balance affordability with perceived value play a crucial role, given the competition with private label brands and varying consumer price sensitivities. Effective distribution networks, covering both traditional grocery channels and emerging online platforms, are vital for maintaining a competitive edge.

New and Emerging Companies:

While key players dominate the Hummus market, new and emerging companies are entering the sector, often focusing on specific hummus variations or introducing innovative and health-focused hummus products. These entrants may emphasize unique flavor profiles, plant-based and organic ingredients, or target specific dietary preferences, contributing to the overall diversification and innovation in the Hummus market. Although their market share may be relatively modest compared to industry leaders, these companies play a role in driving trends and meeting the evolving demands of health-conscious and adventurous consumers.

Industry Trends:

The Hummus market has witnessed noteworthy industry news and investment trends in 2023. Key players are investing in sustainability initiatives, responding to the growing consumer awareness of environmental impact. Collaborations with chickpea growers and agricultural organizations contribute to ensuring a consistent and responsibly sourced supply of chickpeas, a key ingredient in hummus. Additionally, investments in technology adoption, such as advanced processing methods and packaging innovations, aim to enhance production efficiency and maintain the freshness and quality of hummus products.

Competitive Scenario:

The overall competitive scenario in the Hummus market is marked by intense rivalry among key players striving to capture a larger share of the growing market. The industry's competitiveness is evident in the emphasis on innovation, sustainability, and strategic collaborations to address evolving consumer preferences. The global reach of these companies enables them to adapt to regional tastes, capitalize on emerging markets, and navigate regulatory landscapes, contributing to the overall dynamism of the industry.

Key Players:

Lancaster Colony Corporation

SABRA DIPPING CO., LLC

Bakkavor Group plc

Boar’s Head Brand

Tribe Mediterranean Foods, Inc.

SAVENCIA SA

Abraham's Natural Foods

Ithaca Hummus

CEDAR’S MEDITERRANEAN FOODS, INC.

Lantana Foods

Haliburton International Foods, Inc.

Roots Hummus

Hannah Foods

PELOPAC INC.

Recent Development in 2023:

Sabra: Introducing high-protein hummus selections with extra nuts and seeds to appeal to customers who are health-conscious and exercise aficionados.