Health Consciousness

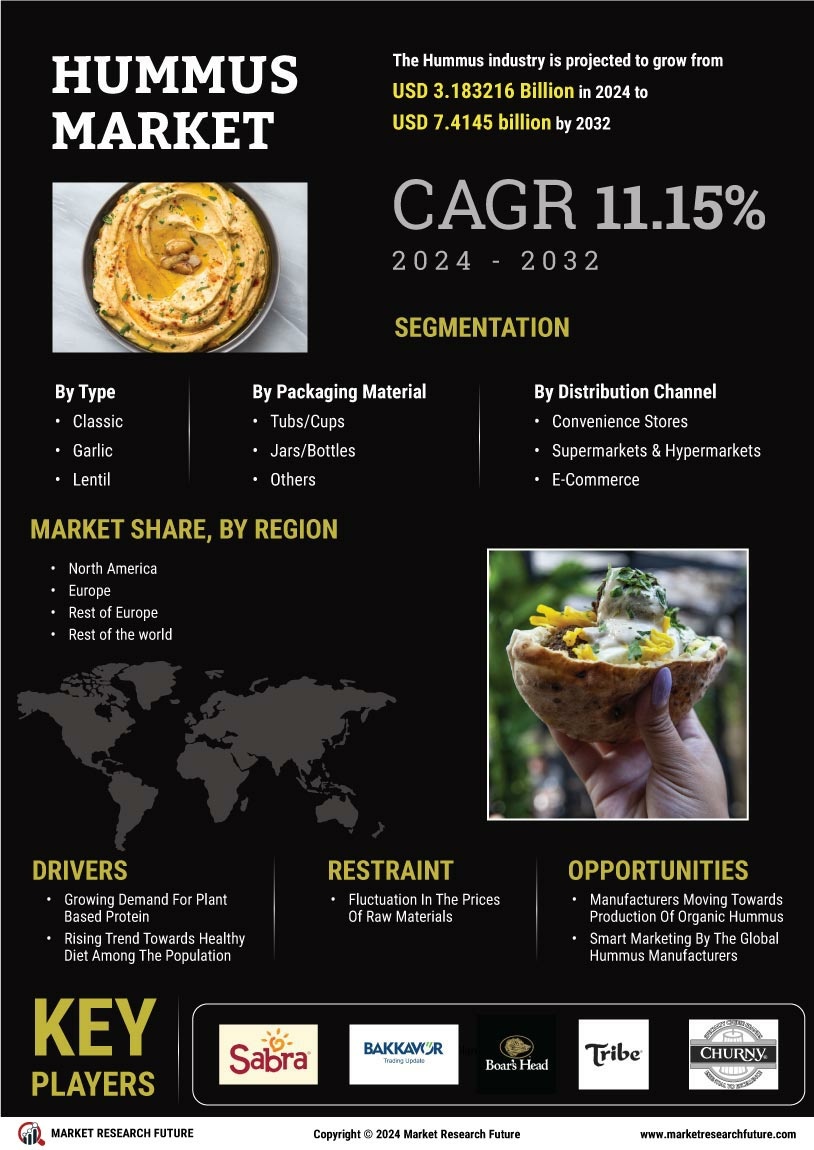

The increasing awareness of health and nutrition among consumers appears to be a primary driver for the Hummus Market. As individuals seek healthier snack alternatives, hummus, with its rich protein and fiber content, has gained popularity. According to recent data, the demand for plant-based foods has surged, with the hummus segment experiencing a notable growth rate of approximately 7% annually. This trend indicates that consumers are gravitating towards products that align with their health goals, thereby propelling the Hummus Market forward. Furthermore, the rise of veganism and vegetarianism has contributed to the expansion of this market, as hummus serves as a versatile and nutritious option for those adhering to plant-based diets.

Sustainability Trends

Sustainability is increasingly influencing consumer purchasing decisions, thereby impacting the Hummus Market. As environmental concerns rise, consumers are more inclined to choose products that are packaged sustainably and produced with eco-friendly practices. Many hummus brands are now adopting biodegradable or recyclable packaging solutions, which resonate with environmentally conscious consumers. Market Research Future indicates that products marketed as sustainable can command a premium price, suggesting that there is a willingness among consumers to pay more for eco-friendly options. This trend not only enhances brand loyalty but also positions companies favorably within the competitive landscape of the Hummus Market, as sustainability becomes a key differentiator.

Flavor Diversification

Flavor innovation within the Hummus Market is becoming increasingly prominent, as manufacturers experiment with various ingredients to cater to diverse consumer preferences. Traditional flavors such as garlic and roasted red pepper are now complemented by exotic options like beetroot and spicy harissa. This diversification strategy not only attracts new customers but also retains existing ones by offering them novel experiences. Market data suggests that flavored hummus products have seen a growth rate of around 10% in recent years, indicating a strong consumer appetite for unique taste profiles. As the market continues to evolve, the introduction of limited-edition flavors and seasonal offerings may further enhance consumer engagement and drive sales in the Hummus Market.

Cultural and Culinary Trends

The globalization of culinary practices is significantly influencing the Hummus Market, as consumers become more adventurous in their food choices. The increasing popularity of Mediterranean cuisine has led to a heightened interest in hummus, which is often viewed as a staple in various cultural diets. This trend is reflected in the growing number of restaurants and food service establishments incorporating hummus into their menus, further driving its consumption. Market data suggests that the restaurant segment of the hummus market is expanding, with a growth rate of around 6% annually. As culinary trends continue to evolve, the integration of hummus into diverse dishes may further enhance its appeal and drive growth within the Hummus Market.

Convenience and Ready-to-Eat Options

The demand for convenience foods is reshaping the Hummus Market, as busy lifestyles prompt consumers to seek quick and easy meal solutions. Ready-to-eat hummus products, often packaged with dippers or paired with vegetables, are gaining traction among consumers looking for nutritious snacks that require minimal preparation. Recent statistics indicate that the ready-to-eat segment of the hummus market has expanded significantly, with a growth rate of approximately 8% annually. This trend suggests that manufacturers are responding to consumer needs by providing convenient options that align with modern eating habits. As the market evolves, the introduction of single-serve packaging may further enhance the appeal of hummus as a go-to snack in the Hummus Market.