Growing Need for Contactless Solutions

The growing need for contactless solutions is significantly influencing the Hospital Logistics Robot Market. As healthcare facilities seek to minimize physical interactions, logistics robots offer a practical solution for transporting supplies and medications without human contact. This trend is particularly relevant in environments where infection control is paramount. The market is expected to see a rise in demand for contactless logistics solutions, with projections indicating a 10% increase in adoption rates over the next few years. This shift towards automation and contactless operations is likely to enhance the Hospital Logistics Robot Market, as hospitals adapt to evolving healthcare needs.

Technological Advancements in Robotics

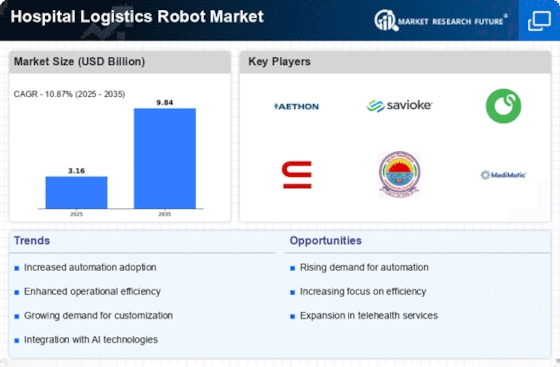

Technological advancements are significantly influencing the Hospital Logistics Robot Market. Innovations in robotics, such as improved navigation systems and artificial intelligence, are enhancing the capabilities of logistics robots. These advancements allow robots to perform complex tasks, such as delivering medications and supplies, with greater accuracy and efficiency. The market is projected to grow at a compound annual growth rate of 15% over the next five years, driven by these technological improvements. As hospitals increasingly adopt these advanced systems, the Hospital Logistics Robot Market is likely to expand, offering new opportunities for manufacturers and service providers.

Cost Reduction Initiatives in Healthcare

Cost reduction initiatives are a primary driver of the Hospital Logistics Robot Market. Healthcare providers are under constant pressure to lower operational costs while maintaining high-quality services. The integration of logistics robots has been shown to reduce labor costs and improve supply chain efficiency. Reports suggest that hospitals implementing these robots can achieve savings of up to 20% in logistics-related expenses. As financial constraints continue to challenge healthcare systems, the adoption of robotics in logistics is likely to become a strategic priority, thereby fueling growth in the Hospital Logistics Robot Market.

Rising Demand for Efficiency in Healthcare Operations

The Hospital Logistics Robot Market is experiencing a notable surge in demand for enhanced operational efficiency. Hospitals are increasingly seeking solutions that streamline logistics, reduce wait times, and optimize resource allocation. According to recent data, hospitals that have integrated logistics robots report a 30% reduction in operational costs. This trend is driven by the need to improve patient care while managing limited resources effectively. As healthcare facilities strive to maintain high standards of service, the adoption of logistics robots appears to be a viable solution. The Hospital Logistics Robot Market is thus positioned to grow as more institutions recognize the potential benefits of automation in their logistics processes.

Increasing Focus on Patient Safety and Quality of Care

The Hospital Logistics Robot Market is also being propelled by a heightened focus on patient safety and quality of care. Hospitals are recognizing that logistics robots can minimize human error in the delivery of medications and supplies, thereby enhancing patient safety. Data indicates that facilities utilizing logistics robots have reported a 25% decrease in medication errors. This emphasis on safety aligns with broader healthcare trends aimed at improving patient outcomes. As hospitals prioritize quality care, the demand for logistics robots is expected to rise, further driving growth in the Hospital Logistics Robot Market.