North America : Market Leader in Integration Services

North America continues to lead the Hospital IT Systems Integration Services market, holding a significant share of 5.25 billion. The growth is driven by increasing healthcare digitization, regulatory support for interoperability, and rising demand for efficient patient management systems. The region's focus on advanced technologies, such as AI and cloud computing, further propels market expansion.

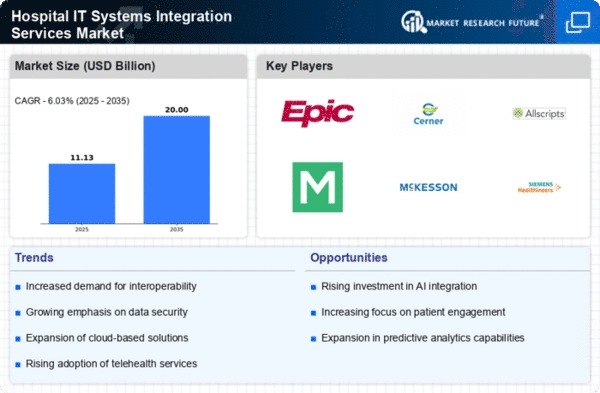

Key players like Epic Systems, Cerner, and McKesson dominate the landscape, supported by a robust healthcare infrastructure. The U.S. remains the largest contributor, with ongoing investments in healthcare IT solutions. The competitive environment is characterized by innovation and strategic partnerships aimed at enhancing service delivery and patient outcomes.

Europe : Emerging Market with Growth Potential

Europe's Hospital IT Systems Integration Services market is valued at €3.0 billion, driven by increasing regulatory mandates for data sharing and interoperability. The region is witnessing a shift towards integrated healthcare solutions, fueled by the need for improved patient care and operational efficiency. Government initiatives promoting digital health are also significant growth catalysts.

Leading countries like Germany, France, and the UK are at the forefront, with major players such as Siemens Healthineers and Philips Healthcare actively expanding their offerings. The competitive landscape is evolving, with a focus on collaboration among healthcare providers and technology firms to enhance integration capabilities. The European market is poised for substantial growth as healthcare systems adapt to new technologies and patient needs.

Asia-Pacific : Rapidly Growing Healthcare Sector

The Asia-Pacific region, valued at $2.5 billion, is experiencing rapid growth in Hospital IT Systems Integration Services. Factors such as increasing healthcare expenditure, a growing aging population, and rising demand for advanced healthcare solutions are driving this trend. Governments are also investing in digital health initiatives to enhance service delivery and patient care.

Countries like China, India, and Japan are leading the charge, with a mix of local and international players competing in the market. Companies like Oracle and IBM are expanding their presence, focusing on tailored solutions for diverse healthcare needs. The competitive landscape is characterized by innovation and strategic partnerships aimed at improving healthcare integration and efficiency.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region, with a market size of $0.75 billion, is in the early stages of developing Hospital IT Systems Integration Services. The growth is driven by increasing investments in healthcare infrastructure and a rising demand for integrated healthcare solutions. However, challenges such as regulatory hurdles and varying levels of technological adoption across countries remain significant.

Countries like the UAE and South Africa are leading the way, with local and international players exploring opportunities in this emerging market. The competitive landscape is still developing, with a focus on building partnerships to enhance service delivery and address the unique healthcare needs of the region. As the market matures, there is potential for significant growth in IT integration services.