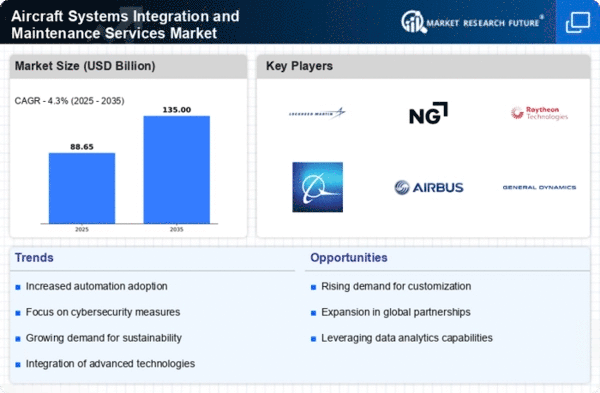

The Aircraft Systems Integration and Maintenance Services Market is characterized by a dynamic competitive landscape, driven by technological advancements and increasing demand for efficient aircraft operations. Key players such as Lockheed Martin (US), Boeing (US), and Airbus (FR) are strategically positioned to leverage their extensive experience and innovation capabilities. Lockheed Martin (US) focuses on integrating advanced technologies into military and commercial aircraft, while Boeing (US) emphasizes digital transformation and sustainability in its maintenance services. Airbus (FR), on the other hand, is enhancing its service offerings through partnerships aimed at improving operational efficiency and reducing lifecycle costs. Collectively, these strategies contribute to a competitive environment that is increasingly centered around technological innovation and customer-centric solutions.In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to enhance responsiveness and reduce costs. The market structure appears moderately fragmented, with several key players exerting significant influence. This fragmentation allows for a variety of service offerings, yet the presence of major companies like Northrop Grumman (US) and Raytheon Technologies (US) suggests a competitive concentration in certain segments, particularly in defense-related services.

In November Northrop Grumman (US) announced a strategic partnership with a leading technology firm to develop AI-driven maintenance solutions for military aircraft. This collaboration is poised to enhance predictive maintenance capabilities, thereby reducing downtime and operational costs. The integration of AI into maintenance processes signifies a shift towards more proactive service models, which could redefine industry standards.

In October Raytheon Technologies (US) unveiled a new digital platform designed to streamline aircraft maintenance operations. This platform aims to provide real-time data analytics and insights, enabling operators to make informed decisions regarding maintenance schedules and resource allocation. The introduction of such digital solutions reflects a broader trend towards data-driven decision-making in the industry, potentially enhancing overall efficiency.

In September Boeing (US) expanded its maintenance services portfolio by acquiring a regional service provider specializing in aircraft systems integration. This acquisition is expected to bolster Boeing's capabilities in providing comprehensive maintenance solutions, particularly in emerging markets. The strategic move underscores Boeing's commitment to enhancing its service offerings and expanding its global footprint.

As of December the competitive trends in the Aircraft Systems Integration and Maintenance Services Market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate in order to innovate and meet evolving customer demands. Looking ahead, competitive differentiation is likely to shift from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability, as companies strive to deliver superior value in a rapidly changing market.