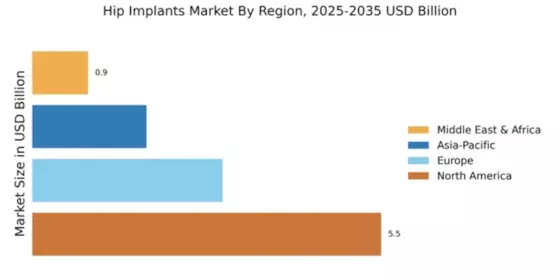

Market Growth Projections

The Global Hip Implants Market Industry is projected to experience substantial growth over the coming years. By 2024, the market is anticipated to reach 10.2 USD Billion, with further growth expected to 14.9 USD Billion by 2035. This trajectory suggests a robust demand for hip implants driven by various factors, including demographic changes and advancements in medical technology. The compound annual growth rate (CAGR) of 3.54% from 2025 to 2035 indicates a steady expansion of the market, reflecting the increasing need for hip replacement surgeries and the ongoing development of innovative implant solutions.

Technological Advancements

Technological innovations in hip implant design and materials are transforming the Global Hip Implants Market Industry. The introduction of minimally invasive surgical techniques, coupled with advanced materials such as ceramics and titanium alloys, enhances the durability and performance of implants. These advancements not only improve patient outcomes but also reduce recovery times, making hip replacement surgeries more appealing. For example, the development of 3D printing technology allows for customized implants tailored to individual patient anatomy, which could potentially lead to better fit and function. Such innovations are likely to contribute to the market's growth, with projections indicating a CAGR of 3.54% from 2025 to 2035.

Rising Geriatric Population

The increasing geriatric population globally is a primary driver of the Global Hip Implants Market Industry. As individuals age, the incidence of hip-related ailments, such as osteoarthritis and fractures, tends to rise significantly. For instance, by 2024, the global market is projected to reach 10.2 USD Billion, largely due to the growing number of elderly individuals requiring hip replacement surgeries. This demographic shift necessitates advanced medical solutions, thereby propelling demand for hip implants. Furthermore, the World Health Organization indicates that the population aged 65 and older is expected to double by 2050, further emphasizing the need for effective orthopedic interventions.

Rising Healthcare Expenditure

The growing healthcare expenditure across various regions is positively influencing the Global Hip Implants Market Industry. Governments and private sectors are investing significantly in healthcare infrastructure, which includes orthopedic services. This increase in funding allows for better access to advanced medical technologies and surgical procedures, thereby facilitating more hip replacement surgeries. For instance, countries with robust healthcare systems are witnessing a surge in hip implant procedures, reflecting the willingness to invest in quality healthcare. As healthcare spending continues to rise, the demand for hip implants is expected to grow, aligning with the overall expansion of the healthcare market.

Awareness and Education Initiatives

Awareness and education initiatives regarding hip health and available treatment options are crucial drivers of the Global Hip Implants Market Industry. Healthcare organizations and professionals are increasingly focusing on educating the public about the importance of early diagnosis and treatment of hip disorders. Campaigns aimed at promoting healthy lifestyles and preventive measures are likely to lead to earlier interventions, which may require hip implants. As patients become more informed about their options, the demand for hip replacement surgeries is expected to rise. This growing awareness is essential for fostering a proactive approach to hip health, ultimately contributing to market growth.

Increasing Prevalence of Hip Disorders

The rising prevalence of hip disorders, including arthritis and traumatic injuries, is a significant factor driving the Global Hip Implants Market Industry. As lifestyles become more sedentary and obesity rates increase, the incidence of hip-related conditions is likely to escalate. According to health statistics, millions of individuals worldwide suffer from hip pain, leading to a greater demand for surgical interventions. This trend is expected to sustain the market's growth trajectory, with estimates suggesting that by 2035, the market could reach 14.9 USD Billion. The increasing awareness of treatment options among patients further fuels the demand for hip implants, as more individuals seek solutions for their hip-related ailments.