Advancements in Treatment Modalities

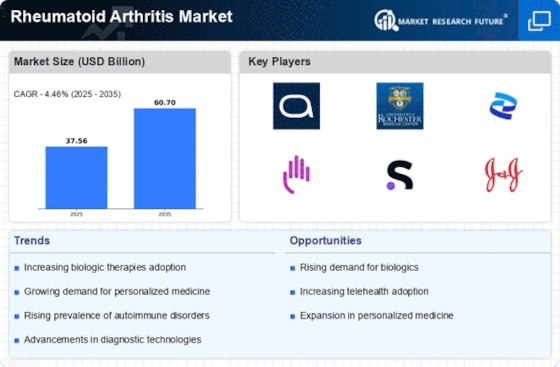

Recent advancements in treatment modalities significantly influence the Rheumatoid Arthritis Market. The introduction of novel biologic agents and targeted therapies has transformed the therapeutic landscape, offering patients more effective options. For instance, the market for biologics is projected to reach USD 50 billion by 2026, indicating a robust growth trajectory. These innovations not only improve disease management but also enhance the quality of life for patients. Additionally, the development of personalized medicine approaches, which tailor treatments based on individual patient profiles, is gaining traction. This shift towards more precise therapies is expected to drive further investment in research and development within the Rheumatoid Arthritis Market, fostering a competitive environment that prioritizes patient-centric solutions.

Integration of Digital Health Solutions

The integration of digital health solutions is emerging as a transformative driver in the Rheumatoid Arthritis Market. Telemedicine, mobile health applications, and wearable devices are increasingly utilized to monitor disease progression and enhance patient engagement. These technologies facilitate real-time communication between patients and healthcare providers, allowing for timely interventions and personalized care plans. The market for digital health solutions in rheumatology is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% through 2026. This trend not only improves patient outcomes but also streamlines healthcare delivery, making it more efficient. As digital health solutions become more prevalent, they are likely to reshape the landscape of the Rheumatoid Arthritis Market, fostering a more connected and informed patient population.

Rising Awareness and Education Initiatives

Rising awareness and education initiatives play a crucial role in shaping the Rheumatoid Arthritis Market. Efforts by healthcare organizations and advocacy groups to educate both patients and healthcare providers about the disease are increasing. These initiatives aim to improve understanding of rheumatoid arthritis, its symptoms, and the importance of early diagnosis and treatment. As awareness grows, more individuals are likely to seek medical attention, leading to higher diagnosis rates and, consequently, increased demand for treatment options. Furthermore, educational campaigns that highlight the benefits of adherence to prescribed therapies may enhance treatment outcomes. This heightened awareness is expected to drive growth in the Rheumatoid Arthritis Market, as more patients engage with healthcare systems and explore available therapeutic options.

Growing Investment in Research and Development

The increasing investment in research and development is a pivotal driver for the Rheumatoid Arthritis Market. Pharmaceutical companies and research institutions are allocating substantial resources to discover new therapies and improve existing ones. In 2025, it is anticipated that R&D spending in the rheumatology sector will exceed USD 10 billion, reflecting a commitment to addressing unmet medical needs. This influx of funding supports clinical trials, which are essential for validating the efficacy and safety of new treatments. Moreover, collaborations between academia and industry are becoming more prevalent, facilitating the exchange of knowledge and accelerating the development of innovative solutions. As a result, the Rheumatoid Arthritis Market is poised for significant advancements, ultimately benefiting patients and healthcare providers alike.

Increase in Prevalence of Rheumatoid Arthritis

The rising prevalence of rheumatoid arthritis is a critical driver for the Rheumatoid Arthritis Market. As the population ages, the incidence of this autoimmune disorder appears to increase, with estimates suggesting that approximately 1.3 million individuals in the United States alone are affected. This growing patient population necessitates the development and availability of effective treatment options, thereby propelling market growth. Furthermore, the increasing awareness of the disease among healthcare professionals and patients contributes to earlier diagnosis and treatment initiation, which may enhance patient outcomes. Consequently, the demand for innovative therapies and management solutions in the Rheumatoid Arthritis Market is likely to escalate, reflecting the urgent need for comprehensive care strategies.