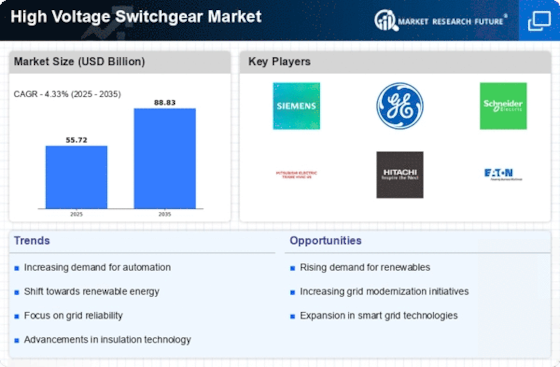

Rising Demand for Electricity

The increasing demand for electricity across various sectors is a primary driver for the High Voltage Switchgear Market. As urbanization and industrialization continue to expand, the need for reliable and efficient power distribution systems becomes paramount. According to recent data, electricity consumption is projected to rise significantly, necessitating the installation of high voltage switchgear to manage the increased load. This trend is particularly evident in developing regions, where infrastructure development is accelerating. The High Voltage Switchgear Market is thus positioned to benefit from this surge in demand, as utilities and industries seek to enhance their grid capabilities and ensure uninterrupted power supply.

Growing Focus on Grid Modernization

The modernization of electrical grids is a significant driver for the High Voltage Switchgear Market. Aging infrastructure in many regions necessitates upgrades to enhance reliability and efficiency. Smart grid initiatives are gaining traction, aiming to improve the management of electricity distribution and reduce losses. The integration of high voltage switchgear is essential for these modernization efforts, as it facilitates better control and monitoring of power flows. As investments in grid modernization continue to rise, the High Voltage Switchgear Market is expected to expand, driven by the need for innovative solutions that support a more resilient and efficient energy landscape.

Investment in Renewable Energy Projects

The transition towards renewable energy sources is reshaping the High Voltage Switchgear Market. Governments and private entities are investing heavily in solar, wind, and hydroelectric projects, which require advanced switchgear solutions for efficient energy management. The International Energy Agency indicates that renewable energy capacity is expected to grow substantially, leading to an increased need for high voltage switchgear to connect these sources to the grid. This shift not only supports sustainability goals but also drives innovation within the High Voltage Switchgear Market, as manufacturers develop products tailored to the unique requirements of renewable energy integration.

Technological Advancements in Switchgear Design

Technological advancements are significantly influencing the High Voltage Switchgear Market. Innovations such as digital switchgear, which incorporates smart technologies, enhance operational efficiency and reliability. These advancements allow for real-time monitoring and predictive maintenance, reducing downtime and operational costs. The market is witnessing a shift towards more compact and modular designs, which facilitate easier installation and maintenance. As utilities and industries increasingly adopt these technologies, the High Voltage Switchgear Market is likely to experience robust growth, driven by the demand for modernized infrastructure that can support evolving energy needs.

Regulatory Support for Infrastructure Development

Regulatory frameworks play a crucial role in shaping the High Voltage Switchgear Market. Governments worldwide are implementing policies that promote infrastructure development, particularly in the energy sector. These regulations often include incentives for upgrading existing power systems and investing in new technologies. As a result, utilities are compelled to adopt high voltage switchgear solutions that comply with these standards. The emphasis on safety, reliability, and environmental sustainability in regulatory policies further propels the demand for advanced switchgear systems. Consequently, the High Voltage Switchgear Market is likely to thrive as stakeholders align their strategies with regulatory expectations.