High Purity Solvents Size

High Purity Solvents Market Growth Projections and Opportunities

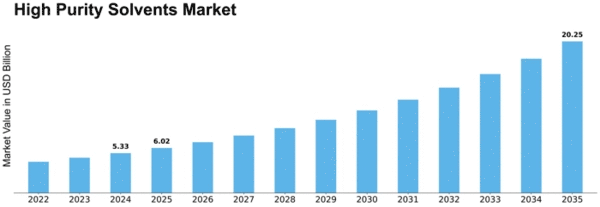

In 2022, the High Purity Solvents Market Size reached USD 37.2 Billion. The High Purity Solvents Market is forecasted to register a CAGR of 6.90% from USD 39.8 Billion in 2023 to USD 67.8 Billion by 2032. Several factors shape the high-purity solvents market and drive its movements as a whole. Industries such as pharmaceuticals, electronics, and analytical laboratories depend on high-purity solvents with low impurities and high chemical purity for their manufacturing processes. The growing demand for pharmaceuticals and biotechnology is one of the most prominent drivers of the growth trajectory of the global high-purity solvent market. Technological advancements in manufacturing procedures and purification practices have made significant contributions to how the high-purity solvent market functions today. Ongoing research aims to improve solvent efficiency, reduce impurities, and create bespoke formulations for different industries. Government regulations and industry standards play an important role in shaping the High Purity Solvents Market. There is a need for compliance with pharmaceutical manufacturing regulations, electronic fabrication guidelines, and analytical testing protocols when dealing with solvent suppliers. The use of solvents in semiconductor manufacturing and electronic device assembly has particularly had significant effects on the purity Solvent industry due to its close association with Electronics Industry Applications (EIA). High-solvent solids are necessary for cleaning, etching, or deposition purposes during electronics fabrication activities. High Purity Solvents Market dynamics are influenced by economic factors such as R&D outlays, among others. The increased spending on research, along with economic progress, accounts for much of this increasing demand for first-rate solvents within laboratories, research institutions & product developers worldwide. Conversely, in times of economic downturns, industrial production may decrease, or budgets allocated to research might be decreased based on varying business cycles. Competition determines how markets react within industries. Companies invest in research and development to create innovative solvent formulations, improve manufacturing efficiency, and meet the evolving needs of end-users. The High Purity Solvents Market is affected by global trade dynamics and supply chain considerations. Pricing of specialty chemicals, distillation products, etc., are influenced by international trade policies, transportation costs, and the global demand for high-purity solvents. Environmental concerns have become more significant in the High Purity Solvents Market. These include sustainable sourcing options, recycling initiatives, or the development of environmentally friendly solvents. The awareness campaigns that educate consumers about how important high-purity solvents are in key applications help drive market growth. As industries and laboratories become aware of the significance of high-purity solvents in ensuring product quality as well as safety and reliability, there will be an increasing demand for such tailor-made solutions.

Leave a Comment