Market Growth Projections

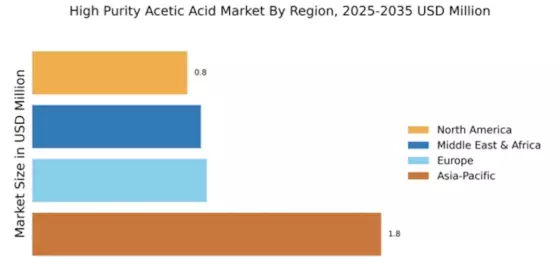

The Global High Purity Acetic Acid Market Industry is projected to experience substantial growth over the coming years. With a market value expected to reach 10.0 USD Billion in 2024 and further expand to 18.6 USD Billion by 2035, the industry is poised for a robust upward trajectory. The anticipated compound annual growth rate (CAGR) of 5.8% from 2025 to 2035 highlights the increasing demand across various sectors, including chemicals, food and beverage, and pharmaceuticals. This growth reflects the essential role of high purity acetic acid in diverse applications, reinforcing its significance in the global market.

Emerging Markets and Urbanization

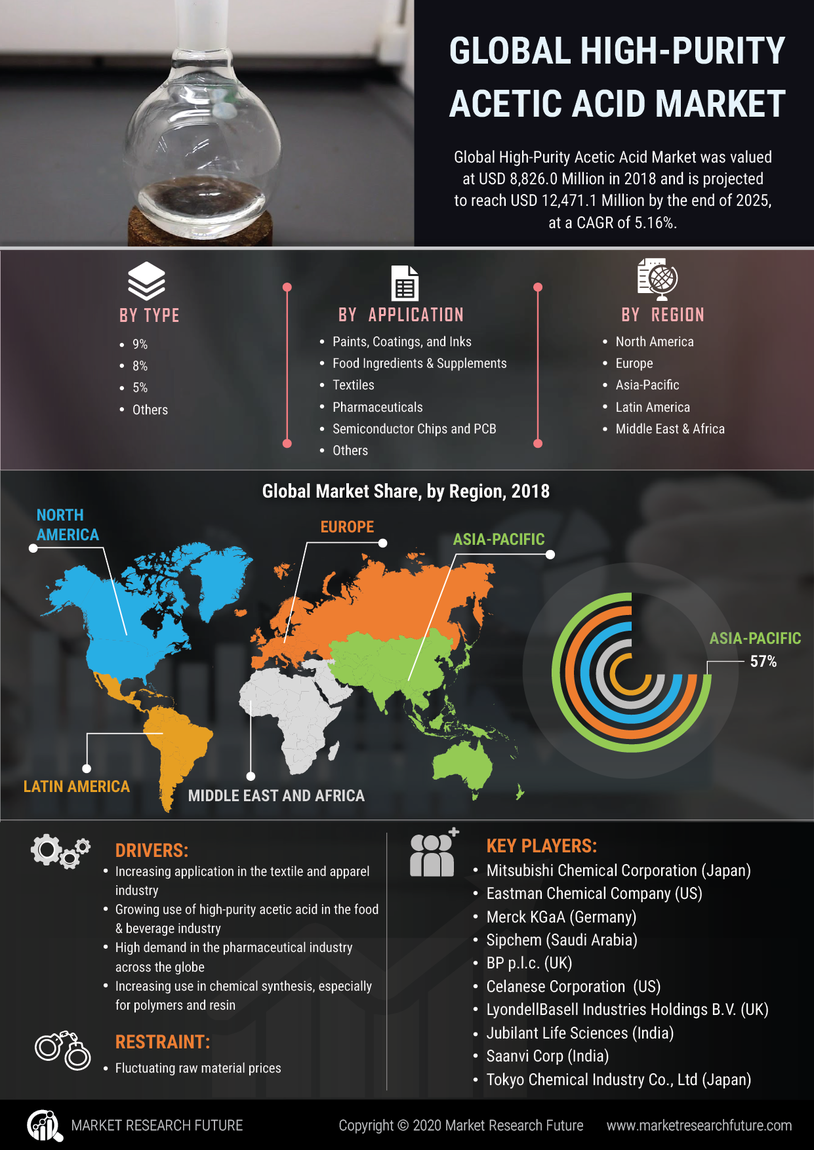

Emerging markets and urbanization are key drivers of the Global High Purity Acetic Acid Market Industry. Rapid urbanization in developing regions leads to increased industrial activities and a higher demand for chemicals, including high purity acetic acid. As countries industrialize, the need for high-quality chemical inputs becomes paramount, driving market growth. This trend is particularly evident in Asia-Pacific, where urbanization rates are among the highest globally. The combination of rising industrial demand and urban population growth is likely to propel the market forward, creating new opportunities for producers and suppliers.

Increasing Use in Pharmaceuticals

The Global High Purity Acetic Acid Market Industry is witnessing an increase in the use of high purity acetic acid within the pharmaceutical sector. Acetic acid is essential in synthesizing various pharmaceutical compounds, including analgesics and antibiotics. As the global population ages and the demand for healthcare products rises, pharmaceutical companies are increasingly relying on high purity acetic acid to ensure the quality and efficacy of their products. This growing reliance is expected to bolster the market, contributing to its anticipated growth trajectory and reinforcing the importance of high purity acetic acid in the pharmaceutical supply chain.

Growth in Food and Beverage Sector

The Global High Purity Acetic Acid Market Industry benefits from the expanding food and beverage sector, where acetic acid is utilized as a preservative and flavoring agent. With the rising consumer preference for natural and organic products, food manufacturers are increasingly incorporating high purity acetic acid to enhance product quality and shelf life. This trend is expected to contribute to the market's growth, with projections indicating a market value of 18.6 USD Billion by 2035. The food and beverage industry's emphasis on quality and safety further underscores the importance of high purity acetic acid in meeting regulatory standards.

Rising Demand in Chemical Manufacturing

The Global High Purity Acetic Acid Market Industry experiences a surge in demand driven by its extensive applications in chemical manufacturing. Acetic acid serves as a vital feedstock for producing various chemicals, including acetate esters, which are crucial for solvents and coatings. As industries increasingly focus on sustainable and eco-friendly production methods, high purity acetic acid becomes a preferred choice due to its low impurities. This trend is reflected in the projected market value, which is anticipated to reach 10.0 USD Billion in 2024, indicating a robust growth trajectory as manufacturers seek high-quality inputs.

Technological Advancements in Production

Technological advancements in the production of high purity acetic acid are significantly influencing the Global High Purity Acetic Acid Market Industry. Innovations in production processes, such as improved catalytic methods and purification techniques, enhance the efficiency and yield of acetic acid production. These advancements not only reduce production costs but also minimize environmental impact, aligning with global sustainability goals. As a result, the market is poised for growth, with a projected compound annual growth rate (CAGR) of 5.8% from 2025 to 2035, reflecting the industry's adaptation to modern production challenges.