Regulatory Compliance

Regulatory compliance is becoming an increasingly important driver for the High Performance Polymer Market. Governments and regulatory bodies are implementing stringent guidelines regarding material safety, environmental impact, and product performance. High performance polymers, which often meet or exceed these regulations, are gaining traction in various applications. For instance, in the automotive sector, regulations aimed at reducing emissions and enhancing safety standards are pushing manufacturers to adopt advanced materials. The market is likely to see a growth rate of approximately 5% as companies prioritize compliance to maintain competitiveness. Additionally, the ability of high performance polymers to meet these regulatory standards positions them favorably against traditional materials, thereby enhancing their market share.

Sustainability Initiatives

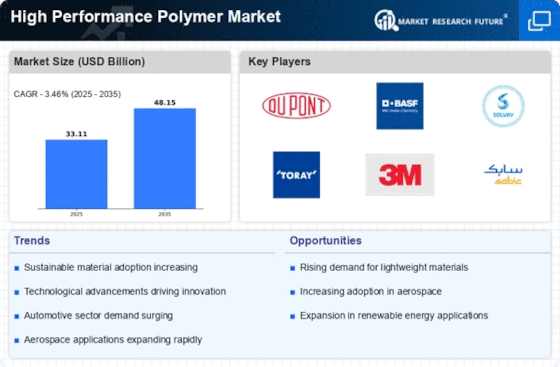

The increasing emphasis on sustainability is a pivotal driver for the High Performance Polymer Market. As industries strive to reduce their carbon footprint, the demand for eco-friendly materials has surged. High performance polymers, known for their durability and lightweight properties, are being adopted in various applications, including packaging and automotive sectors. The market for these polymers is projected to grow at a compound annual growth rate of approximately 7% over the next five years, driven by the need for sustainable solutions. Companies are investing in research and development to create bio-based and recyclable polymers, which aligns with global sustainability goals. This shift not only enhances the market appeal of high performance polymers but also encourages innovation in material science, thereby expanding their application scope.

Technological Advancements

Technological advancements play a crucial role in shaping the High Performance Polymer Market. Innovations in polymer processing techniques and material formulations have led to the development of superior performance characteristics. For instance, advancements in additive manufacturing and 3D printing technologies are enabling the production of complex geometries that were previously unattainable. This has opened new avenues for high performance polymers in sectors such as aerospace, where weight reduction and enhanced performance are critical. The market is expected to witness a significant uptick, with estimates suggesting a growth rate of around 8% annually as manufacturers increasingly adopt these technologies. Furthermore, the integration of smart materials into high performance polymers is anticipated to enhance their functionality, making them more appealing to various industries.

Growing Demand in Aerospace and Automotive

The aerospace and automotive sectors are experiencing a burgeoning demand for high performance polymers, significantly influencing the High Performance Polymer Market. These sectors require materials that can withstand extreme conditions while maintaining lightweight properties. High performance polymers are increasingly being utilized in components such as fuel systems, structural parts, and interior applications. The aerospace industry, in particular, is projected to grow at a rate of 6% annually, driven by the need for fuel-efficient and high-strength materials. Similarly, the automotive sector is shifting towards lightweight materials to enhance fuel efficiency and reduce emissions, further propelling the demand for high performance polymers. This trend indicates a robust market potential, as manufacturers seek to innovate and meet the evolving requirements of these industries.

Rising Investment in Research and Development

Rising investment in research and development is a significant driver for the High Performance Polymer Market. As industries seek to innovate and improve product performance, companies are allocating substantial resources to R&D initiatives. This investment is crucial for developing new polymer formulations that offer enhanced properties such as heat resistance, chemical stability, and mechanical strength. The market is projected to grow at a rate of 7% annually, fueled by these advancements. Furthermore, collaborations between academic institutions and industry players are fostering innovation, leading to the emergence of novel applications for high performance polymers. This trend not only enhances the competitive landscape but also ensures that the market remains dynamic and responsive to changing consumer needs.