Growth in Renewable Energy Sector

The High Performance Plastics Market is poised for growth due to the increasing investments in the renewable energy sector. As the world shifts towards sustainable energy solutions, high performance plastics are becoming essential in applications such as wind turbine blades and solar panel components. These materials offer durability and resistance to environmental factors, making them ideal for renewable energy applications. Market projections suggest that the renewable energy sector could contribute significantly to the high performance plastics market, with an anticipated growth rate of around 10% over the next few years. This trend reflects a broader commitment to sustainability and the need for materials that can withstand the rigors of renewable energy production.

Increasing Applications in Electronics

The High Performance Plastics Market is witnessing a significant expansion in applications within the electronics sector. As electronic devices become more compact and sophisticated, the demand for materials that can withstand high temperatures and provide electrical insulation is rising. High performance plastics, such as polyimides and fluoropolymers, are increasingly utilized in components like circuit boards and connectors. Market data indicates that the electronics segment is expected to account for over 25% of the total high performance plastics market by 2026. This growth is driven by the ongoing miniaturization of electronic devices and the need for materials that can perform reliably under extreme conditions.

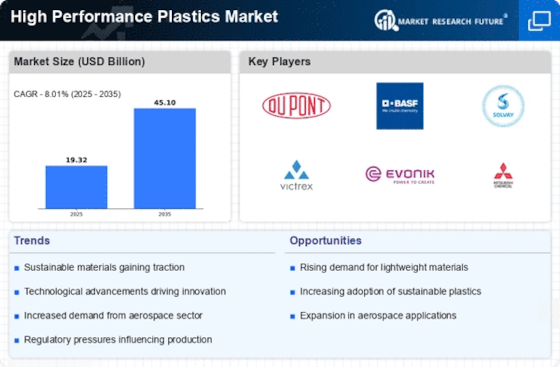

Rising Demand for Lightweight Materials

The High Performance Plastics Market is experiencing a notable surge in demand for lightweight materials, particularly in sectors such as aerospace and automotive. As manufacturers strive to enhance fuel efficiency and reduce emissions, the adoption of high performance plastics has become increasingly prevalent. These materials offer superior strength-to-weight ratios compared to traditional materials, which is crucial for applications where weight reduction is paramount. For instance, the aerospace sector is projected to witness a compound annual growth rate of approximately 5% in the use of lightweight materials, driving the demand for high performance plastics. This trend is likely to continue as industries seek innovative solutions to meet stringent regulatory standards and consumer expectations for sustainability.

Advancements in Manufacturing Technologies

Technological innovations in manufacturing processes are significantly influencing the High Performance Plastics Market. The introduction of advanced techniques such as additive manufacturing and injection molding has enhanced the production capabilities of high performance plastics. These advancements allow for greater precision, reduced waste, and the ability to create complex geometries that were previously unattainable. For example, the adoption of 3D printing in the production of high performance plastics is expected to grow, with market estimates suggesting a potential increase in market share by 15% over the next five years. This evolution in manufacturing not only improves efficiency but also expands the application range of high performance plastics across various industries.

Regulatory Compliance and Safety Standards

The High Performance Plastics Market is significantly influenced by stringent regulatory compliance and safety standards across various sectors. Industries such as automotive, aerospace, and healthcare are subject to rigorous regulations that mandate the use of materials that meet specific performance criteria. High performance plastics are often favored due to their ability to meet these demanding standards, including resistance to chemicals, heat, and wear. As regulations continue to evolve, manufacturers are increasingly turning to high performance plastics to ensure compliance while maintaining product integrity. This trend is likely to drive market growth, as companies prioritize safety and sustainability in their material choices.