Top Industry Leaders in the High Performance Computing Market

Competitive Landscape of the High-Performance Computing Market:

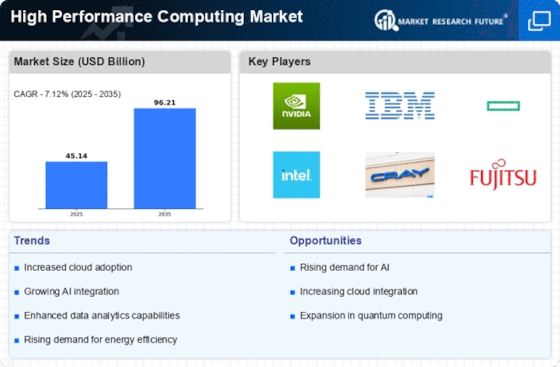

The High-Performance Computing (HPC) market is a dynamic and rapidly evolving landscape, characterized by intense competition between established players and emerging startups. This market is driven by ongoing technological advancements, increasing demand for computational power across various industries, and the growing adoption of cloud based HPC solutions. Understanding the competitive landscape is crucial for businesses seeking to gain a foothold in this lucrative market.

Key Players:

- IBM Corporation

- Hewlett Packard Enterprise Company

- Intel Corporation

- Microsoft Corporation

- Cisco Systems, Inc.

- Inspur, Inc.

- Fujitsu Ltd

- Oracle Corporation

- Dell, Inc.

- Dawning Information Industry Co.ltd

Strategies Adopted:

The key strategies adopted by players in the HPC market include:

- Focus on innovation: Continuously developing new technologies and solutions to address evolving customer needs.

- Expansion into new markets: Targeting new industries and applications for HPC solutions.

- Strengthening partnerships: Collaborating with other companies to offer comprehensive and integrated solutions.

- Focus on cloud-based HPC: Providing HPC solutions as a service model to cater to increasing demand for flexibility and scalability.

- Acquisitions and mergers: Strengthening market position and portfolio through strategic acquisitions and mergers.

Factors for Market Share Analysis:

Several factors influence market share in the HPC market, including:

- Market share of different components: Servers, storage, networking, software, and services.

- Revenue generated by different segments: On-premise, cloud-based, and hybrid deployments.

- Industry-specific market share: Healthcare, manufacturing, finance, research, and others.

- Geographic market share: North America, Europe, Asia Pacific, and others.

- Brand recognition and reputation: Customer perception and trust in specific brands.

- Innovation capacity: Ability to develop and roll out new technologies and solutions.

- Strength of partnerships and alliances: Collaboration with other companies to offer comprehensive solutions.

- Pricing strategies: Competitiveness and attractiveness of pricing models.

- Customer service and support: Quality and responsiveness of customer service.

New and Emerging Companies:

Several new and emerging companies are entering the HPC market, offering innovative solutions and challenging the established players. These companies focus on specific niches and cater to the evolving needs of customers. Some notable examples include:

- Cerebras Systems: Offers wafer-scale AI chips for high-performance computing.

- Graphcore: Provides IPUs (Intelligence Processing Units) for AI and machine learning applications.

- SiPearl: Develops a European processor architecture optimized for HPC workloads.

- Cohesity: Offers a data management platform that integrates with HPC environments.

- Fungible: Provides data processing units (DPUs) for accelerating HPC workloads.

Current Company Investment Trends:

Recent company investment trends in the HPC market include:

- Increased investment in cloud-based HPC solutions: Companies are investing heavily in developing and expanding their cloud-based HPC offerings to cater to the growing demand for flexible and scalable solutions.

- Focus on artificial intelligence and machine learning: Companies are integrating AI and ML capabilities into their HPC solutions to enable advanced analytics and data-driven decision making.

- Investment in quantum computing: Several companies are investing in research and development of quantum computing technologies, aiming to offer next-generation HPC solutions.

- Focus on sustainability: Companies are developing energy-efficient HPC solutions to reduce carbon footprint and cater to growing environmental concerns.

- Investment in cybersecurity: Companies are investing in cybersecurity solutions to protect HPC

Latest Company Updates:

At its Ludwigshafen location, BASF began up a new supercomputer in 2023 to replace the old one. The new supercomputer has a computational capacity of 3 petaflops, which is significantly greater than its 1.75 petaflop predecessor.

A new generation of High-Performance Computing Cluster, targeted for large-scale model training, was released by Tencent Cloud in 2023. Three improvements have been made to the overall performance from the previous one. Tencent Cloud's in-house created servers, fitted with the newest NVIDIA H800 GPUs, are used in this cluster. Large-scale model training, autonomous driving, scientific computing, and other applications can benefit from the high-performance, high-bandwidth, and low-latency cluster computing capability offered by the servers' 3.2T connection bandwidth.

HCLTech said on Wednesday, March 2023, that it has extended its partnership with Microsoft in order to offer high-performance computing (HPC) solutions to customers across many industries. Over a three-year period, HCLTech intends to train 3,000 people and establish a lab-cum-center of excellence (CoE) in partnership with Microsoft.