Rising Demand for 5G Technology

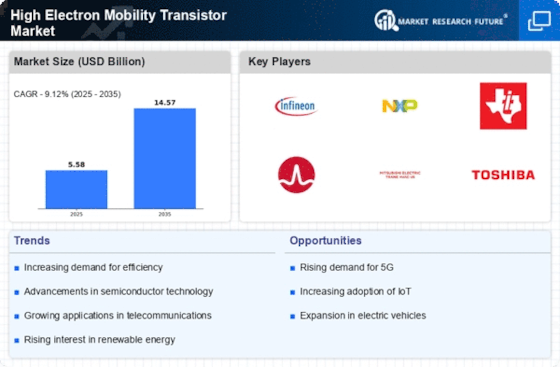

The High Electron Mobility Transistor Market is experiencing a surge in demand due to the rapid deployment of 5G technology. This next-generation wireless communication standard requires advanced semiconductor devices that can handle higher frequencies and faster data rates. High Electron Mobility Transistors (HEMTs) are particularly well-suited for this application, as they offer superior performance in terms of speed and efficiency. As telecommunications companies invest heavily in infrastructure to support 5G, the market for HEMTs is projected to grow significantly. Analysts estimate that the demand for HEMTs in 5G applications could account for a substantial portion of the overall market, potentially reaching billions in revenue by the end of the decade.

Advancements in Consumer Electronics

The High Electron Mobility Transistor Market is witnessing growth driven by advancements in consumer electronics. As devices become more sophisticated, the need for high-performance components that can support faster processing speeds and improved energy efficiency is paramount. HEMTs are increasingly being integrated into smartphones, tablets, and other electronic devices, enhancing their performance capabilities. Market data suggests that the consumer electronics sector is one of the largest consumers of HEMTs, with a projected market share that could reach over 30% by 2026. This trend indicates a robust demand for HEMTs as manufacturers seek to meet consumer expectations for high-quality, efficient electronic products.

Expansion of Renewable Energy Sources

The High Electron Mobility Transistor Market is likely to benefit from the increasing focus on renewable energy sources. As countries strive to reduce carbon emissions and transition to sustainable energy, the demand for efficient power conversion systems is rising. HEMTs are utilized in various renewable energy applications, including solar inverters and wind turbine converters, due to their high efficiency and low power loss. The market for HEMTs in renewable energy applications is expected to expand, with projections indicating a compound annual growth rate that could exceed 10% over the next several years. This trend underscores the critical role of HEMTs in facilitating the global shift towards cleaner energy solutions.

Increased Investment in Defense and Aerospace

The High Electron Mobility Transistor Market is poised for growth due to increased investment in defense and aerospace sectors. These industries require advanced electronic components that can operate under extreme conditions and provide high reliability. HEMTs are favored in radar systems, satellite communications, and other critical applications due to their superior performance characteristics. The defense sector's focus on modernizing its technology infrastructure is likely to drive demand for HEMTs, with projections indicating a potential increase in market size as defense budgets expand. This trend highlights the strategic importance of HEMTs in supporting national security and advanced aerospace initiatives.

Emerging Applications in Internet of Things (IoT)

The High Electron Mobility Transistor Market is experiencing growth due to the emergence of applications in the Internet of Things (IoT). As IoT devices proliferate, the need for efficient and high-speed communication technologies becomes increasingly critical. HEMTs are well-suited for IoT applications, providing the necessary performance for data transmission and processing. The market for HEMTs in IoT is expected to grow, with estimates suggesting that it could capture a significant share of the overall semiconductor market. This growth is indicative of the broader trend towards interconnected devices and smart technologies, positioning HEMTs as essential components in the evolving landscape of IoT.