Rising Demand for Drug Discovery

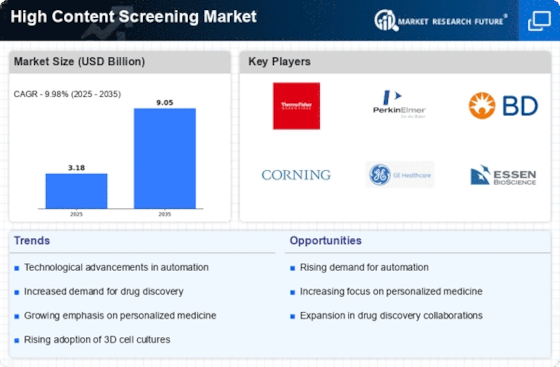

The High Content Screening Market is experiencing a notable increase in demand driven by the need for efficient drug discovery processes. Pharmaceutical companies are increasingly adopting high content screening technologies to enhance their drug development pipelines. This shift is largely attributed to the growing complexity of diseases and the need for more targeted therapies. In 2025, the market for drug discovery is projected to reach approximately 50 billion USD, with high content screening playing a pivotal role in this growth. The ability to analyze multiple cellular parameters simultaneously allows researchers to identify potential drug candidates more effectively, thereby reducing the time and cost associated with traditional screening methods. As a result, the High Content Screening Market is poised for substantial growth as it aligns with the evolving needs of the pharmaceutical sector.

Emergence of Personalized Medicine

The High Content Screening Market is significantly impacted by the emergence of personalized medicine, which emphasizes tailored therapeutic approaches based on individual patient profiles. As healthcare shifts towards more personalized treatment strategies, high content screening technologies are becoming indispensable for understanding patient-specific responses to drugs. In 2025, the personalized medicine market is projected to reach approximately 30 billion USD, with high content screening playing a crucial role in biomarker discovery and validation. These technologies enable the identification of unique cellular characteristics that can inform treatment decisions, thereby enhancing patient outcomes. Consequently, the High Content Screening Market is expected to grow in tandem with the increasing focus on personalized medicine.

Growing Investment in Biotechnology

The High Content Screening Market is benefiting from the growing investment in biotechnology, which is fostering innovation and research in this field. As biotechnology companies seek to develop novel therapeutics and diagnostics, the need for advanced screening technologies becomes increasingly critical. In 2025, the biotechnology sector is anticipated to attract investments exceeding 100 billion USD, with high content screening technologies being essential for the development of new products. These technologies facilitate the analysis of cellular responses to various stimuli, enabling researchers to uncover insights that drive biotechnological advancements. Thus, the High Content Screening Market is likely to thrive as it aligns with the broader trends in biotechnology investment.

Increased Focus on Toxicology Testing

The High Content Screening Market is witnessing a surge in the emphasis on toxicology testing, particularly in the context of regulatory compliance and safety assessments. As industries face stricter regulations regarding chemical safety, the demand for high content screening technologies that can provide comprehensive toxicity profiles is on the rise. In 2025, the toxicology testing market is expected to exceed 20 billion USD, with high content screening methodologies being integral to this expansion. These technologies enable researchers to assess the effects of compounds on cellular health and viability, thereby facilitating the identification of potential toxic effects early in the development process. Consequently, the High Content Screening Market is likely to benefit from this trend as organizations seek to enhance their safety evaluation processes.

Advancements in Automation and Robotics

The High Content Screening Market is significantly influenced by advancements in automation and robotics, which are transforming laboratory workflows. The integration of automated high content screening systems allows for increased throughput and reproducibility in experiments. In 2025, the automation market within life sciences is projected to reach around 15 billion USD, with high content screening technologies being a key component. These automated systems not only reduce human error but also enable researchers to conduct more complex experiments with greater efficiency. As laboratories strive to optimize their operations, the demand for automated high content screening solutions is expected to rise, thereby propelling the growth of the High Content Screening Market.