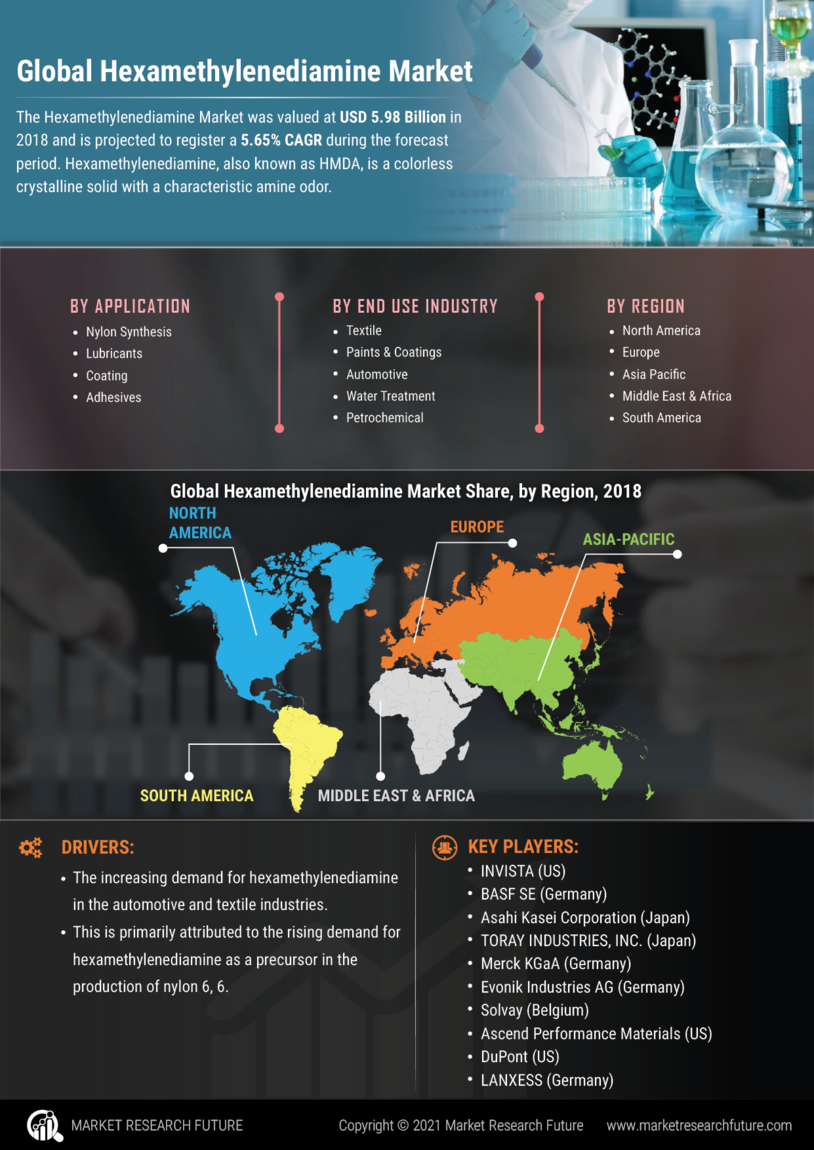

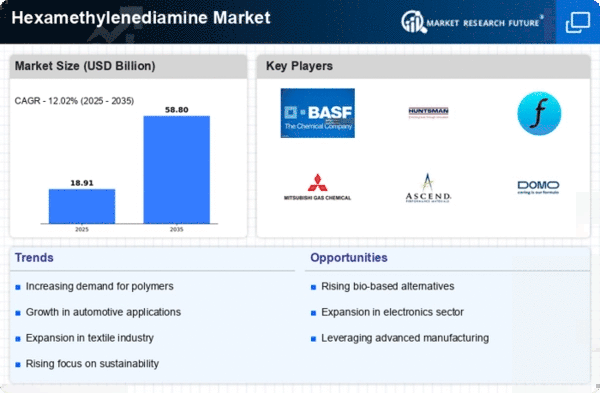

North America : Established Market with Growth Potential

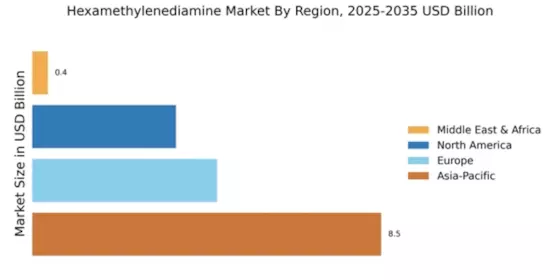

The North American hexamethylenediamine market is projected to reach $3.5 million by December 2025, driven by increasing demand in automotive and construction sectors. Regulatory support for sustainable practices and innovations in chemical manufacturing are key growth catalysts. The region's focus on reducing carbon emissions is also influencing market dynamics, leading to a shift towards eco-friendly production methods.

Leading countries like the US and Canada dominate the market, with major players such as Huntsman Corporation and Invista establishing a strong presence. The competitive landscape is characterized by strategic partnerships and technological advancements. As companies invest in R&D, the market is expected to witness enhanced product offerings and improved supply chain efficiencies.

Europe : Innovation and Sustainability Focus

Europe's hexamethylenediamine market is anticipated to grow significantly, reaching $4.5 million by December 2025. The region benefits from stringent regulations promoting sustainable chemical production, which drives innovation and demand. The automotive and textile industries are key consumers, with a growing emphasis on eco-friendly materials and processes, aligning with the EU's Green Deal objectives.

Germany, France, and the UK are leading countries in this market, hosting major players like BASF SE and Domo Chemicals. The competitive landscape is marked by a strong focus on R&D and collaboration among industry stakeholders. As companies adapt to regulatory changes, the market is poised for robust growth, with an increasing number of sustainable product offerings.

Asia-Pacific : Rapid Growth and Market Leadership

Asia-Pacific is the largest market for hexamethylenediamine, projected to reach $8.5 million by December 2025. The region's growth is fueled by rising industrialization, particularly in countries like China and India, where demand for hexamethylenediamine in textiles and automotive applications is surging. Government initiatives to boost manufacturing and infrastructure development are also significant growth drivers.

China and Japan are the leading countries in this market, with key players such as Mitsubishi Gas Chemical Company and Nippon Shokubai Co., Ltd. establishing strong footholds. The competitive landscape is characterized by rapid technological advancements and increasing investments in production capacity. As the region continues to expand, the market is expected to see a rise in innovative applications and product diversification.

Middle East and Africa : Emerging Market with Growth Opportunities

The Middle East and Africa hexamethylenediamine market is projected to reach $0.38 million by December 2025, driven by increasing industrial activities and infrastructure projects. The region's growth is supported by government initiatives aimed at diversifying economies and enhancing manufacturing capabilities. As demand for hexamethylenediamine rises in construction and automotive sectors, the market is poised for gradual expansion.

Countries like South Africa and the UAE are emerging as key players in this market. The competitive landscape is still developing, with local and international companies vying for market share. As investments in infrastructure and industrialization increase, the presence of key players is expected to grow, leading to enhanced market dynamics and opportunities for innovation.