Market Trends

Key Emerging Trends in the Hexamethylenediamine Market

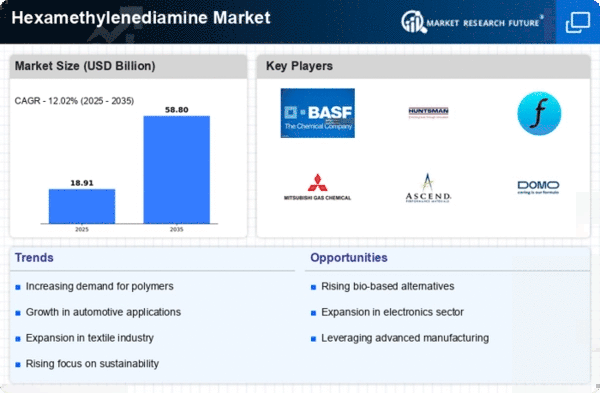

The trends affecting hexamethylenediamine (HMDA) markets are experiencing noticeable shifts, which include growing demand for nylon production, technological developments in manufacturing techniques, and increasing emphasis on sustainability. Its use as a key building block for nylon 66 production and polyurethane resins makes it applicable in textiles, automotive, and adhesives, among many other industries. One major trend witnessed in this industry is an increased preference for sustainable or bio-based options besides conventional ones. Owing to its use as a precursor to nylon 66, among others, there has been more demand for nylon 66, especially from the automobile industry, with consumer goods following closely behind it due to high strength properties like durability against wear and tear under high temperatures used to make parts such as auto components, electric connectors among others. Technological advancement is another important development taking place within the HMDA sector's manufacturing processes. Manufacturers continue to invest in research work aimed at making production activities related to HMDA safer for the surrounding environment while at the same time improving their cost effectiveness so that global warming can be reduced significantly. The general focus here regards technological innovations that will make HMDA a more competitive product in the market by ensuring a continuous supply of derivatives to these industries. Furthermore, the HMDA market is showing a shift on a geographical basis as well. Although North America and Europe have traditionally been major players, Asia-Pacific has also emerged as one of the significant contributors to the global HMDA industry. Demand for HMDA in different applications, such as textile or automobile components, is driven by strong industrial growth witnessed in this region, particularly in China and India. Asian production capacities, which are closer to consumers and complemented by an expanding consumer base, serve to increase their importance in relation to HMDA. Additionally, the market is responding to an increased need for polyurethane resins produced using hexamethylenediamine (HMDA). Polyurethanes from diisocyanates combined with HMDA are utilized in adhesives, coatings, and foam making. As industries seek versatile and high-performance materials, they drive up demand for HMDA due to the increased use of polyurethane resins. This trend is seen mostly within packaging sectors, but it is also relevant for construction and furniture because, based on polyurethanes, varieties of products can be manufactured.

Leave a Comment