Market Analysis

In-depth Analysis of Hemorrhoids Treatment Market Industry Landscape

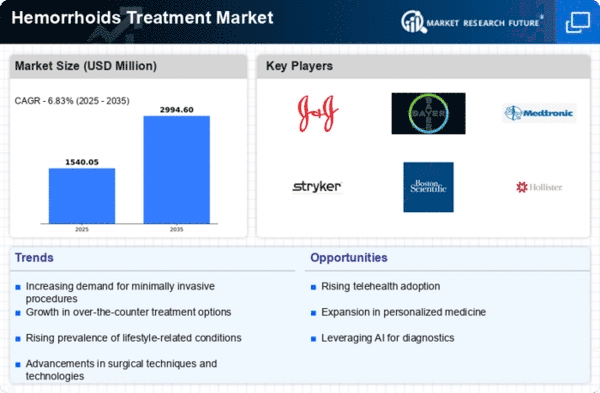

The market for hemorrhoids treatments tends to be a typical illness that affects a significant portion of the population. A growing population, dietary preferences, and changes in lifestyle all have an impact on market factors in this area, which fuels consumer demand for accessible and effective treatment options. The market factors related to Hemorrhoids Treatment are closely linked to the widespread nature of this ailment and the rise in general awareness. The market is growing as more people seek out therapeutic counsel for hemorrhoidal difficulties as awareness campaigns educate people about the negative effects and readily available solutions. The unquestionable quality of over-the-counter products for the treatment of hemorrhoids is a remarkable market dynamic. Drug stores now provide a variety of lotions, treatments, and suppositories due to self-care habits and the need for cost-effective, non-remedy solutions. This phenomenon is changing consumer attitudes and the market. New developments in minimally intrusive technique are providing possibilities for hemorrhoids treatment beyond the cautious mediations of the past. Reduced recovery periods and less anxiety are bringing about a shift in treatment preferences for procedures including infrared coagulation, sclerotherapy, and elastic band ligation. Comfort and accommodations for patients are essential to the evolving market components. Manufacturers and sellers of medical supplies are concentrating on developing therapies that are less intrusive, need shorter recovery times, and can be administered in acute situations. The focus on ongoing, goal-driven care is influencing the operations and item plans. The availability of cost-effective over-the-counter remedies and the inclusion of protection for systems might impact people's choices about hemorrhoidal treatment. Patients are utilizing a wider range of medications, medical devices, and tactics, leading to a more diverse and competitive market. The exchange of best practices is becoming easier because to globalization, which is also accelerating the advancement of therapy. Medical care providers emphasize the role that lifestyle modifications, exercise, and food habits have in preventing and managing hemorrhoids. This educational facility influences the behavior of patients and contributes to a holistic approach to hemorrhoid treatment.

Leave a Comment