Increasing Healthcare Expenditure

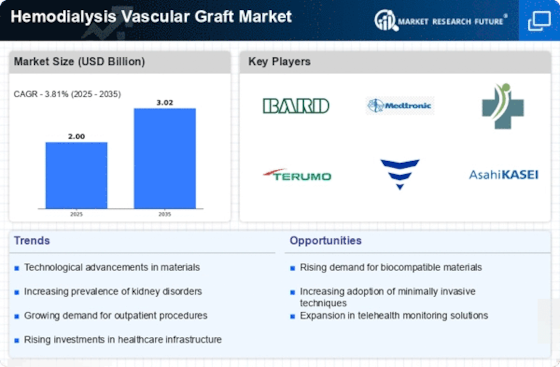

Rising healthcare expenditure across various regions is a crucial factor driving the Hemodialysis Vascular Graft Market. Governments and private sectors are allocating more resources to improve healthcare infrastructure, particularly in renal care. This increase in funding allows for the procurement of advanced medical devices, including high-quality vascular grafts. Reports indicate that healthcare spending is projected to grow at a compound annual growth rate (CAGR) of around 5% over the next few years. This financial commitment to healthcare is expected to enhance the availability and accessibility of hemodialysis treatments, thereby boosting the demand for vascular grafts in the Hemodialysis Vascular Graft Market.

Rising Incidence of Kidney Diseases

The increasing prevalence of chronic kidney diseases (CKD) is a primary driver for the Hemodialysis Vascular Graft Market. As the population ages and lifestyle-related health issues rise, the demand for effective dialysis solutions intensifies. According to recent data, approximately 10% of the population worldwide suffers from some form of kidney disease, leading to a heightened need for hemodialysis treatments. This surge in patient numbers necessitates the use of vascular grafts, which are essential for establishing reliable access to the bloodstream. Consequently, healthcare providers are increasingly investing in advanced vascular graft technologies to meet this growing demand, thereby propelling the Hemodialysis Vascular Graft Market forward.

Growing Awareness of Dialysis Options

The rising awareness among patients regarding dialysis options is significantly impacting the Hemodialysis Vascular Graft Market. Educational initiatives and outreach programs are informing patients about the benefits of vascular grafts for hemodialysis, leading to increased acceptance and utilization. As patients become more informed about their treatment choices, they are more likely to advocate for the use of vascular grafts, which are known for their efficiency and reliability. This shift in patient behavior is likely to drive demand, as healthcare providers respond to the growing preference for effective dialysis solutions. Consequently, the Hemodialysis Vascular Graft Market is expected to experience sustained growth.

Regulatory Support for Innovative Treatments

Regulatory bodies are increasingly supporting the development and approval of innovative vascular graft technologies, which is a significant driver for the Hemodialysis Vascular Graft Market. Streamlined approval processes and incentives for research and development are encouraging manufacturers to invest in new graft designs and materials. This regulatory environment fosters innovation, allowing for the introduction of products that meet the evolving needs of patients and healthcare providers. As new graft technologies receive regulatory approval, they are likely to gain traction in the market, further enhancing the competitive landscape of the Hemodialysis Vascular Graft Market.

Technological Innovations in Vascular Grafts

Technological advancements in the design and materials of vascular grafts are significantly influencing the Hemodialysis Vascular Graft Market. Innovations such as biocompatible materials and improved graft designs enhance the longevity and functionality of vascular access points. For instance, the introduction of anti-thrombogenic coatings has been shown to reduce complications associated with grafts, thereby improving patient outcomes. The market is witnessing a shift towards grafts that offer better patency rates and lower infection risks. As these technologies evolve, they are likely to attract more healthcare providers to adopt modern graft solutions, further stimulating growth in the Hemodialysis Vascular Graft Market.