North America : Market Leader in Heavy Equipment

North America holds a commanding market share of 39.75% in the Heavy Equipment Repair and Maintenance Services sector, driven by robust infrastructure investments and a growing demand for construction and mining activities. Regulatory support for sustainable practices and safety standards further catalyzes market growth, ensuring compliance and enhancing service quality.

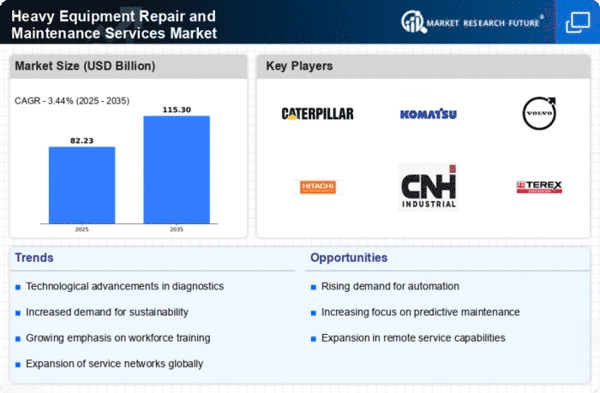

The U.S. stands as the leading country, with major players like Caterpillar Inc and Terex Corporation dominating the landscape. The competitive environment is characterized by innovation and technological advancements, with companies focusing on predictive maintenance and digital solutions to enhance service efficiency. This region's strong economic performance and investment in heavy machinery repair services solidify its market leadership.

Europe : Emerging Market with Growth Potential

Europe's Heavy Equipment Repair and Maintenance Services market is valued at €24.0 billion, reflecting a growing demand driven by infrastructure projects and a shift towards sustainable practices. Regulatory frameworks promoting environmental standards and safety are pivotal in shaping market dynamics, encouraging investments in advanced repair technologies and services.

Leading countries include Germany, the UK, and France, where companies like Volvo Group and Liebherr Group are key players. The competitive landscape is marked by a focus on innovation and service diversification, with firms investing in digital solutions to enhance operational efficiency. The region's commitment to sustainability and regulatory compliance positions it for continued growth in the coming years.

Asia-Pacific : Rapidly Growing Market Dynamics

The Asia-Pacific region, with a market size of $12.0 billion, is witnessing rapid growth in the Heavy Equipment Repair and Maintenance Services sector. This growth is fueled by increasing urbanization, infrastructure development, and a rising demand for mining and construction activities. Regulatory initiatives aimed at improving safety and environmental standards are also driving market expansion, creating opportunities for service providers.

Countries like Japan, China, and South Korea are at the forefront, with companies such as Komatsu Ltd and Doosan Infracore leading the market. The competitive landscape is evolving, with a focus on technological advancements and service efficiency. As the region continues to invest in heavy machinery, the demand for repair and maintenance services is expected to rise significantly.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region, valued at $3.75 billion, is gradually emerging in the Heavy Equipment Repair and Maintenance Services market. Growth is driven by increasing investments in infrastructure and construction projects, alongside a rising demand for mining activities. However, challenges such as regulatory hurdles and economic fluctuations can impact market stability and growth potential.

Countries like South Africa and the UAE are leading the market, with key players such as JCB and Terex Corporation establishing a presence. The competitive landscape is characterized by a mix of local and international firms, focusing on service quality and customer satisfaction. As the region continues to develop its infrastructure, the demand for repair services is anticipated to grow, albeit at a slower pace compared to other regions.