Expansion of the Mining Sector

The Heavy Equipment Lubricant Market is significantly impacted by the ongoing expansion of the mining sector. As mineral extraction activities intensify, the demand for heavy machinery and, consequently, high-performance lubricants is expected to increase. The mining industry is projected to grow at a compound annual growth rate of around 4.5%, driven by rising global demand for minerals and metals. This growth necessitates the use of specialized lubricants that can withstand harsh operating conditions, such as extreme temperatures and heavy loads. Furthermore, the focus on operational efficiency in mining operations is likely to drive the adoption of advanced lubricants, which can enhance equipment performance and reduce maintenance costs. As a result, the expansion of the mining sector is poised to be a key driver for the Heavy Equipment Lubricant Market.

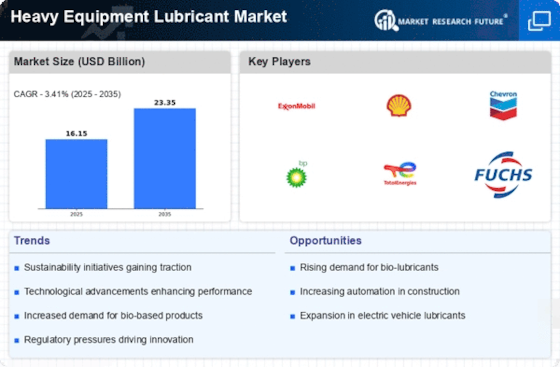

Rising Demand for Heavy Equipment

The Heavy Equipment Lubricant Market is experiencing a notable surge in demand, primarily driven by the expansion of construction and mining sectors. As infrastructure projects proliferate, the need for heavy machinery increases, subsequently elevating the requirement for high-performance lubricants. According to recent data, the construction sector alone is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. This growth is likely to necessitate advanced lubricants that can withstand extreme conditions, thereby enhancing equipment longevity and efficiency. Furthermore, the increasing focus on operational efficiency in heavy machinery is expected to further bolster the demand for specialized lubricants, which are designed to optimize performance and reduce maintenance costs.

Increased Focus on Equipment Maintenance

The Heavy Equipment Lubricant Market is witnessing a heightened emphasis on proactive equipment maintenance strategies. Companies are increasingly recognizing the importance of regular maintenance to enhance the lifespan and efficiency of heavy machinery. This shift is leading to a greater demand for high-quality lubricants that can provide optimal protection and performance. Data suggests that organizations investing in preventive maintenance can reduce equipment downtime by up to 30%, which is a compelling incentive for adopting superior lubricants. As businesses strive to minimize operational disruptions, the demand for specialized lubricants that cater to maintenance needs is expected to rise. This trend not only benefits lubricant manufacturers but also contributes to the overall efficiency of heavy equipment operations.

Regulatory Compliance and Environmental Standards

The Heavy Equipment Lubricant Market is significantly influenced by stringent regulatory frameworks aimed at reducing environmental impact. Governments worldwide are implementing regulations that mandate the use of eco-friendly lubricants, which are less harmful to the environment. This trend is compelling manufacturers to innovate and develop biodegradable and low-toxicity lubricants. The market for environmentally compliant lubricants is anticipated to grow, with estimates suggesting a potential increase of 7% annually. Compliance with these regulations not only enhances brand reputation but also opens new market opportunities for lubricant producers. As companies strive to meet these standards, the demand for high-quality, environmentally friendly lubricants is expected to rise, thereby shaping the future landscape of the Heavy Equipment Lubricant Market.

Technological Innovations in Lubricant Formulations

Technological advancements are playing a pivotal role in the Heavy Equipment Lubricant Market, particularly in the formulation of high-performance lubricants. Innovations such as synthetic lubricants and advanced additive technologies are enhancing the performance characteristics of lubricants, making them more effective in extreme conditions. For instance, synthetic lubricants are known to provide superior thermal stability and oxidation resistance, which are critical for heavy machinery operating under high stress. The market for synthetic lubricants is projected to grow significantly, with estimates indicating a potential increase of 6% annually. This trend towards advanced formulations is likely to drive competition among manufacturers, pushing them to invest in research and development to create cutting-edge products that meet the evolving needs of the heavy equipment sector.