North America : Market Leader in Innovation

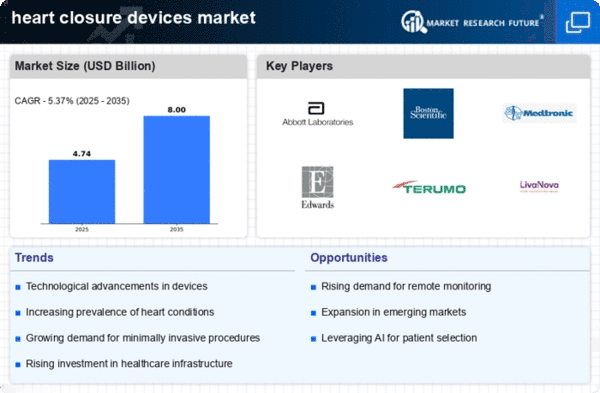

North America continues to lead the heart closure devices market, holding a significant share of 2.25 billion in 2024. The region's growth is driven by advanced healthcare infrastructure, increasing prevalence of cardiovascular diseases, and a strong focus on innovative medical technologies. Regulatory support from agencies like the FDA further catalyzes market expansion, ensuring that new devices meet stringent safety and efficacy standards. The competitive landscape in North America is robust, featuring key players such as Abbott, Boston Scientific, and Medtronic. These companies are at the forefront of technological advancements, offering a range of heart closure devices that cater to diverse patient needs. The presence of established healthcare systems and a high level of investment in R&D contribute to the region's dominance, making it a hub for medical device innovation.

Europe : Emerging Market with Growth Potential

Europe's heart closure devices market is valued at 1.5 billion, reflecting a growing demand driven by an aging population and rising awareness of cardiovascular health. Regulatory frameworks, such as the EU Medical Device Regulation, are enhancing market dynamics by ensuring high safety standards. The region is witnessing an increase in minimally invasive procedures, which is further propelling market growth and adoption of advanced heart closure technologies. Leading countries in Europe include Germany, France, and the UK, where healthcare investments are substantial. Major players like Edwards Lifesciences and LivaNova are actively expanding their product offerings to meet the rising demand. The competitive landscape is characterized by innovation and strategic partnerships, positioning Europe as a key player in The heart closure devices.

Asia-Pacific : Rapidly Growing Market Segment

The Asia-Pacific heart closure devices market, valued at 0.9 billion, is experiencing rapid growth due to increasing healthcare expenditure and a rising prevalence of heart diseases. Countries like China and India are witnessing significant investments in healthcare infrastructure, which is driving demand for advanced medical devices. Regulatory bodies are also becoming more supportive, facilitating quicker approvals for innovative products, thus enhancing market accessibility. In this region, key players such as Terumo Corporation and AtriCure are expanding their presence to capitalize on the growing market. The competitive landscape is evolving, with local manufacturers emerging alongside established global companies. This dynamic environment is expected to foster innovation and improve patient outcomes in heart closure procedures.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa heart closure devices market is valued at 0.35 billion, representing significant untapped potential. The region is witnessing a gradual increase in healthcare investments, driven by government initiatives aimed at improving healthcare access and quality. The rising prevalence of cardiovascular diseases is prompting healthcare providers to adopt advanced medical technologies, including heart closure devices, to enhance patient care. Countries like South Africa and the UAE are leading the way in adopting these technologies, supported by a growing number of healthcare facilities. The competitive landscape is characterized by a mix of local and international players, with companies like W. L. Gore & Associates making strides in the market. As healthcare systems continue to evolve, the demand for heart closure devices is expected to rise, presenting opportunities for growth.