Focus on Vehicle Safety and Security

Safety and security concerns are paramount in the Global Automotive Closure Market Industry, prompting manufacturers to innovate and enhance closure systems. The integration of advanced locking mechanisms, reinforced materials, and crash-resistant designs reflects the industry's response to consumer demands for safer vehicles. Regulatory bodies also impose stringent safety standards, compelling manufacturers to invest in research and development. This focus on safety not only protects occupants but also enhances brand reputation, thereby driving market growth. As safety becomes a key differentiator, the market is likely to evolve, adapting to new challenges and consumer expectations.

Increasing Vehicle Production and Sales

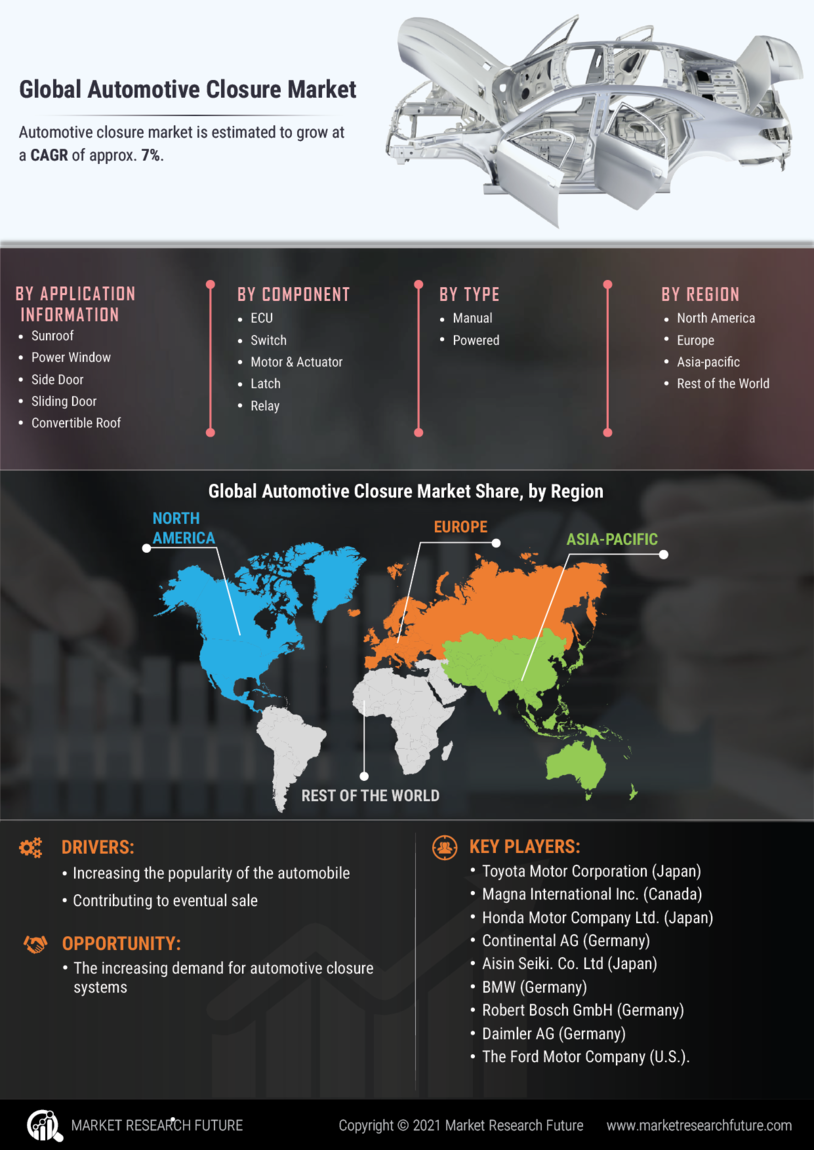

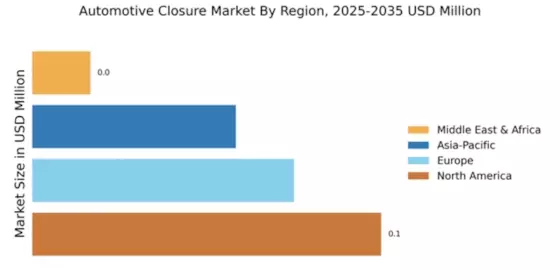

The Global Automotive Closure Market Industry is significantly influenced by the rising production and sales of vehicles worldwide. As emerging economies continue to develop, the demand for personal and commercial vehicles escalates, leading to increased closure requirements. For instance, countries in Asia-Pacific and Latin America are witnessing robust growth in automotive manufacturing, which directly impacts the closure market. This surge in vehicle production is projected to contribute to a compound annual growth rate of 7.74% from 2025 to 2035, underscoring the market's potential for expansion in the coming years.

Growing Demand for Lightweight Materials

The Global Automotive Closure Market Industry experiences a notable shift towards lightweight materials, driven by the automotive sector's focus on enhancing fuel efficiency and reducing emissions. Manufacturers increasingly utilize materials such as aluminum and advanced composites for closures, which contribute to weight reduction without compromising structural integrity. This trend aligns with regulatory pressures for lower emissions, as lighter vehicles typically consume less fuel. As a result, the market is projected to reach 24.9 USD Billion in 2024, reflecting the industry's commitment to sustainability and innovation in design.

Technological Advancements in Closure Systems

Technological innovations play a pivotal role in shaping the Global Automotive Closure Market Industry. The integration of smart technologies, such as electronic locking systems and automated closures, enhances user convenience and vehicle security. Furthermore, advancements in manufacturing processes, including 3D printing and robotics, streamline production and reduce costs. These developments not only improve the functionality of closures but also cater to the evolving preferences of consumers who seek modern, high-tech vehicles. As these technologies proliferate, the market is expected to witness substantial growth, potentially reaching 56.5 USD Billion by 2035.

Environmental Regulations and Sustainability Initiatives

The Global Automotive Closure Market Industry is increasingly shaped by stringent environmental regulations and sustainability initiatives. Governments worldwide are implementing policies aimed at reducing carbon footprints and promoting eco-friendly manufacturing practices. This regulatory landscape encourages automotive manufacturers to adopt sustainable materials and processes in the production of closures. As a result, there is a growing emphasis on recycling and the use of biodegradable materials, which aligns with global sustainability goals. This trend not only meets regulatory requirements but also resonates with environmentally conscious consumers, further driving market growth.