Focus on Value-Based Care

The shift towards value-based care is a significant driver of the Healthcare Interoperability Solution Market. This model emphasizes patient outcomes and cost-effectiveness, necessitating the integration of diverse data sources to evaluate performance effectively. Healthcare providers are increasingly required to demonstrate the quality of care delivered, which can only be achieved through interoperable systems that allow for comprehensive data analysis. As a result, the market is experiencing a surge in demand for solutions that facilitate the collection and sharing of relevant data. It is estimated that by 2026, value-based care models will account for over 50% of healthcare payments, further propelling the need for interoperability.

Rising Demand for Data Sharing

The increasing need for seamless data sharing among healthcare providers is a primary driver of the Healthcare Interoperability Solution Market. As healthcare systems evolve, the demand for integrated solutions that facilitate the exchange of patient information across various platforms is becoming more pronounced. This trend is underscored by the fact that approximately 70% of healthcare organizations report challenges in data sharing. Enhanced interoperability not only improves patient outcomes but also streamlines administrative processes, thereby reducing costs. The Healthcare Interoperability Solution Market is likely to witness substantial growth as organizations seek to overcome these barriers and implement solutions that promote efficient data exchange.

Increased Investment in Healthcare IT

The surge in investment in healthcare information technology is a key driver of the Healthcare Interoperability Solution Market. As healthcare organizations recognize the importance of technology in improving operational efficiency and patient care, funding for IT solutions is on the rise. Reports indicate that healthcare IT spending is expected to reach over 200 billion dollars by 2026, with a significant portion allocated to interoperability solutions. This influx of capital is likely to accelerate the development and adoption of innovative interoperability solutions, enabling healthcare providers to enhance data sharing capabilities and improve overall care delivery.

Regulatory Initiatives and Compliance

Regulatory initiatives aimed at enhancing interoperability are playing a crucial role in shaping the Healthcare Interoperability Solution Market. Governments and regulatory bodies are increasingly mandating that healthcare organizations adopt interoperable systems to improve patient care and safety. For example, recent regulations require healthcare providers to implement standardized data formats and protocols, which are essential for effective data exchange. Compliance with these regulations not only ensures better patient outcomes but also mitigates the risk of penalties for non-compliance. As a result, the market is likely to expand as organizations invest in solutions that meet these regulatory requirements.

Technological Advancements in Healthcare

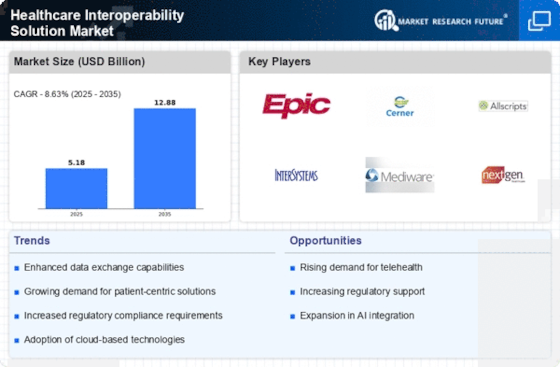

Technological innovations are significantly influencing the Healthcare Interoperability Solution Market. The advent of cloud computing, blockchain technology, and advanced analytics is reshaping how healthcare data is managed and shared. For instance, the integration of cloud-based solutions allows for real-time data access and collaboration among healthcare providers, which is essential for coordinated care. Moreover, the market is projected to grow at a compound annual growth rate of 12% over the next five years, driven by these technological advancements. As healthcare organizations increasingly adopt these technologies, the demand for interoperability solutions that can integrate with existing systems is expected to rise.