Rising Incidence of Stroke

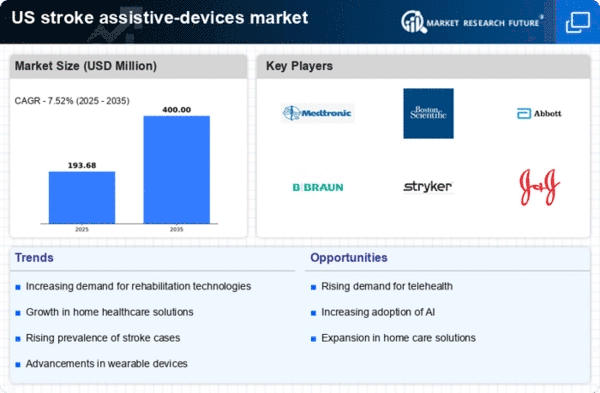

The increasing incidence of stroke in the US is a primary driver for the stroke assistive-devices market. According to the Centers for Disease Control and Prevention (CDC), nearly 795,000 people experience a stroke annually, with a significant portion requiring rehabilitation and assistive devices. This growing patient population necessitates innovative solutions to aid recovery and improve quality of life. As the aging population expands, the demand for effective stroke rehabilitation tools is likely to rise. is expected to grow, as healthcare providers seek to offer comprehensive care solutions that address the needs of stroke survivors. This trend indicates a robust market potential, with projections suggesting a compound annual growth rate (CAGR) of around 7% over the next several years.

Government Initiatives and Funding

Government initiatives aimed at improving stroke care and rehabilitation significantly influence the stroke assistive-devices market. Various federal and state programs are designed to enhance access to rehabilitation services and assistive technologies. For instance, the National Institutes of Health (NIH) has allocated substantial funding for stroke research and rehabilitation technologies, which encourages innovation in the market. Additionally, Medicare and Medicaid reimbursements for assistive devices further stimulate market growth. These funding mechanisms not only support the development of new products but also ensure that patients have access to necessary devices. As a result, the stroke assistive-devices market is likely to benefit from ongoing government support. This may lead to increased adoption rates among healthcare providers and patients..

Aging Population and Chronic Conditions

The aging population in the US is a critical driver of the stroke assistive-devices market. As individuals age, the risk of stroke and other chronic conditions increases, leading to a higher demand for assistive devices. The US Census Bureau projects that by 2030, all baby boomers will be over 65 years old, significantly impacting healthcare needs. This demographic shift necessitates a focus on rehabilitation and support services for stroke survivors. Consequently, the stroke assistive-devices market is expected to grow as manufacturers and healthcare providers respond to the needs of an older population.. It is estimated that the market could expand by approximately 12% annually, driven by the increasing prevalence of stroke among older adults.

Technological Integration in Healthcare

The integration of advanced technologies into healthcare practices is transforming the stroke assistive-devices market. Innovations such as telehealth, artificial intelligence, and smart devices are enhancing the effectiveness of rehabilitation programs. For instance, remote monitoring tools allow healthcare providers to track patient progress in real-time, facilitating timely interventions. This technological evolution not only improves patient outcomes but also encourages the development of new assistive devices that are more user-friendly and effective. As healthcare systems increasingly adopt these technologies, the stroke assistive-devices market is likely to experience significant growth. Projections indicate that the market could see a surge in demand for tech-enabled devices, potentially increasing market size by 15% within the next five years.

Growing Awareness of Rehabilitation Options

There is a notable increase in awareness regarding rehabilitation options available for stroke survivors, which serves as a catalyst for the stroke assistive-devices market. Educational campaigns and community outreach programs have been instrumental in informing patients and caregivers about the benefits of using assistive devices during recovery. This heightened awareness is likely to lead to greater demand for various products, including mobility aids, communication devices, and adaptive technologies. As more individuals recognize the importance of rehabilitation in improving functional outcomes, the stroke assistive-devices market is expected to expand. Market analysts suggest that this trend could result in a 10% increase in device adoption rates over the next few years, reflecting a shift towards proactive recovery strategies.