Rising Demand for Patient-Centric Care

The Health Information Exchange Market is significantly influenced by the rising demand for patient-centric care. Patients are increasingly seeking more control over their health information, which necessitates efficient data sharing among providers. This trend is underscored by the growing emphasis on personalized medicine, where treatment plans are tailored to individual patient needs. Health information exchanges facilitate this by ensuring that all relevant data is accessible to healthcare providers, thereby improving care coordination and outcomes. Market data suggests that organizations prioritizing patient engagement through effective information exchange are likely to see a 15% increase in patient satisfaction scores, further driving the adoption of health information exchange solutions.

Growing Emphasis on Telehealth Services

The growing emphasis on telehealth services is significantly impacting the Health Information Exchange Market. As healthcare providers increasingly adopt telehealth solutions, the need for efficient data exchange becomes paramount. Telehealth relies on the seamless sharing of patient information to ensure continuity of care, particularly for remote consultations. Health information exchanges facilitate this by providing a secure platform for data sharing, which is essential for maintaining the quality of care in virtual settings. Market data suggests that the telehealth sector is expected to grow at a CAGR of 30% through 2026, further driving the demand for health information exchange solutions that support telehealth initiatives.

Technological Advancements in Health IT

Technological advancements in health information technology are propelling the Health Information Exchange Market forward. Innovations such as artificial intelligence and machine learning are enhancing data analytics capabilities, enabling healthcare providers to derive actionable insights from shared information. These technologies facilitate real-time data exchange, which is crucial for timely decision-making in clinical settings. Furthermore, the integration of blockchain technology is emerging as a potential solution for ensuring data integrity and security in exchanges. As these technologies continue to evolve, they are expected to attract significant investments, with the market projected to reach USD 3 billion by 2027, reflecting the transformative impact of technology on health information exchanges.

Increased Focus on Population Health Management

The Health Information Exchange Market is also driven by an increased focus on population health management. Healthcare organizations are recognizing the importance of analyzing health data at a population level to identify trends, manage chronic diseases, and improve overall health outcomes. Health information exchanges play a crucial role in aggregating data from various sources, allowing for comprehensive analysis and reporting. This shift towards data-driven decision-making is likely to enhance the efficiency of healthcare delivery systems. Market analysts indicate that investments in population health management strategies, supported by robust health information exchanges, could lead to a 25% reduction in healthcare costs over the next decade, underscoring the economic benefits of effective data sharing.

Regulatory Support for Health Information Exchange

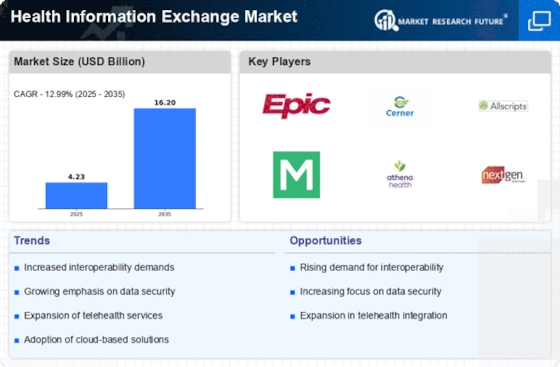

The Health Information Exchange Market is experiencing a surge in regulatory support, which appears to be a pivotal driver. Governments are increasingly recognizing the necessity of seamless data sharing among healthcare providers to enhance patient care. Initiatives such as the 21st Century Cures Act in the United States mandate the adoption of interoperable systems, thereby fostering an environment conducive to the growth of health information exchanges. This regulatory framework not only encourages compliance but also incentivizes healthcare organizations to invest in exchange solutions. As a result, the market is projected to witness a compound annual growth rate of approximately 20% over the next few years, indicating a robust expansion driven by regulatory mandates.