North America : Market Leader in Compliance Services

North America continues to lead the Health Compliance and Regulatory Services Market, holding a significant market share of 7.5 in 2024. The region's growth is driven by stringent regulatory frameworks, increasing healthcare expenditures, and a rising demand for compliance solutions. The presence of advanced technologies and a robust healthcare infrastructure further catalyze market expansion, making it a hub for innovation and regulatory excellence.

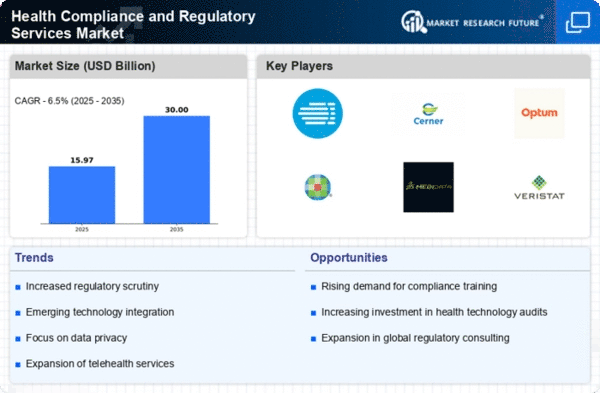

The United States is the primary contributor to this market, with key players like IQVIA, Cerner Corporation, and Optum leading the charge. The competitive landscape is characterized by a mix of established firms and emerging startups, all vying for a share of this lucrative market. The focus on digital health solutions and data analytics is reshaping service offerings, ensuring that North America remains at the forefront of health compliance services.

Europe : Growing Regulatory Landscape

Europe's Health Compliance and Regulatory Services Market is poised for growth, with a market size of 4.5 in 2024. The region benefits from a complex regulatory environment that drives demand for compliance services. Factors such as increasing patient safety concerns, data protection regulations, and the need for standardized practices across countries are key growth drivers. The European Union's emphasis on health data regulations further propels the market forward.

Leading countries in this region include Germany, France, and the UK, where a mix of local and international players operate. Companies like Wolters Kluwer and KPMG are significant contributors to the market. The competitive landscape is evolving, with a focus on integrating technology into compliance processes, ensuring that European firms remain compliant while enhancing operational efficiency.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region, with a market size of 2.5 in 2024, is emerging as a significant player in the Health Compliance and Regulatory Services Market. Rapid economic growth, increasing healthcare investments, and a rising awareness of regulatory requirements are driving demand. Countries like China and India are witnessing a surge in healthcare services, necessitating robust compliance frameworks to meet international standards and local regulations.

The competitive landscape is characterized by a mix of local firms and multinational corporations. Key players are beginning to establish a foothold in this region, focusing on tailored compliance solutions that cater to diverse regulatory environments. As the market matures, the emphasis on technology adoption and training will be crucial for sustaining growth and ensuring compliance across various sectors.

Middle East and Africa : Developing Compliance Frameworks

The Middle East and Africa region, with a market size of 0.5 in 2024, is gradually developing its Health Compliance and Regulatory Services Market. The growth is driven by increasing healthcare investments, government initiatives to improve healthcare quality, and a rising focus on patient safety. Regulatory bodies are beginning to implement stricter compliance measures, which is essential for attracting foreign investments and improving healthcare standards.

Countries like South Africa and the UAE are leading the way in establishing regulatory frameworks. The competitive landscape is still in its infancy, with a few key players starting to emerge. As the region continues to develop, the focus will be on building local expertise and enhancing compliance capabilities to meet international standards and improve healthcare delivery.