North America : Market Leader in Compliance Services

North America continues to lead the Environmental and Regulatory Compliance Services Market, holding a significant market share of 1.25B in 2024. The region's growth is driven by stringent environmental regulations, increasing public awareness, and a shift towards sustainable practices. Demand for compliance services is further fueled by government initiatives aimed at reducing carbon footprints and enhancing environmental protection.

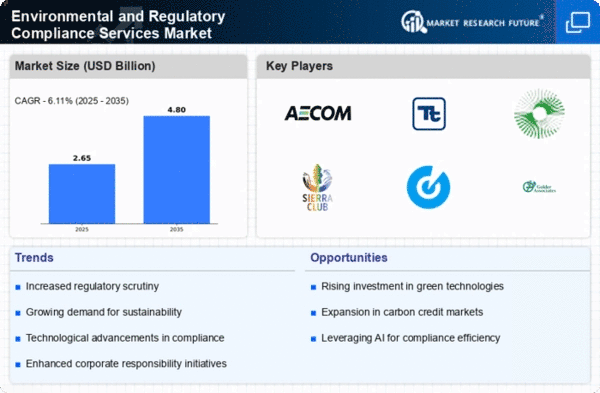

The competitive landscape is robust, with key players such as AECOM, Tetra Tech, and ERM dominating the market. The U.S. and Canada are the leading countries, benefiting from advanced technologies and a strong regulatory framework. The presence of established firms and a growing number of startups contribute to innovation and service diversification, ensuring the region remains at the forefront of environmental compliance.

Europe : Regulatory Framework Driving Growth

Europe's Environmental and Regulatory Compliance Services Market is valued at 0.75B, reflecting a growing emphasis on sustainability and compliance with EU regulations. The region's growth is propelled by the European Green Deal and various national initiatives aimed at achieving climate neutrality. Increasing investments in renewable energy and waste management are also significant drivers of demand for compliance services.

Leading countries such as Germany, France, and the UK are at the forefront of this market, with a competitive landscape featuring firms like Bureau Veritas and SGS. The presence of stringent regulations ensures that companies prioritize compliance, fostering a culture of sustainability. As businesses adapt to evolving regulations, the demand for expert compliance services is expected to rise significantly.

Asia-Pacific : Emerging Market with Potential

The Asia-Pacific region, with a market size of 0.4B, is witnessing rapid growth in Environmental and Regulatory Compliance Services. This growth is driven by increasing industrialization, urbanization, and a rising awareness of environmental issues. Governments are implementing stricter regulations to combat pollution and promote sustainable practices, creating a favorable environment for compliance services.

Countries like China, India, and Japan are leading the charge, with a mix of local and international players such as Ramboll and Golder Associates. The competitive landscape is evolving, with companies focusing on innovative solutions to meet regulatory requirements. As the region continues to develop, the demand for compliance services is expected to grow, driven by both regulatory pressures and corporate responsibility initiatives.

Middle East and Africa : Emerging Compliance Landscape

The Middle East and Africa region, with a market size of 0.1B, is gradually developing its Environmental and Regulatory Compliance Services Market. The growth is primarily driven by increasing awareness of environmental issues and the need for compliance with international standards. Governments are beginning to implement regulations aimed at environmental protection, which is fostering demand for compliance services.

Countries like South Africa and the UAE are taking the lead in establishing regulatory frameworks. The competitive landscape is still emerging, with a few key players starting to make their mark. As the region continues to evolve, the demand for compliance services is expected to rise, driven by both regulatory requirements and a growing emphasis on sustainability.