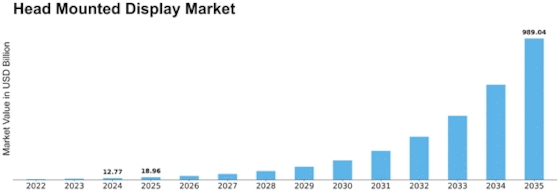

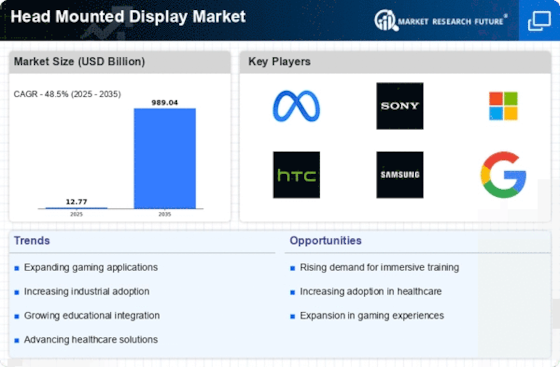

Head Mounted Display Size

Head Mounted Display Market Growth Projections and Opportunities

The Head Mounted Display (HMD) market is significantly influenced by a multitude of market factors that collectively shape its growth trajectory. One of the primary drivers is the escalating demand for immersive virtual and augmented reality experiences across various industries. As businesses increasingly recognize the potential of HMDs in enhancing training, simulation, and visualization processes, the market witnesses a surge in demand. Moreover, the gaming and entertainment sectors play a pivotal role in propelling the adoption of HMDs, as consumers seek more immersive and interactive experiences.

Technological advancements also contribute significantly to the dynamics of the HMD market. Continuous innovations in display technologies, optics, and sensors enhance the overall performance and user experience of HMDs. As these advancements become more accessible and affordable, it stimulates market growth by attracting a broader consumer base. Furthermore, the integration of artificial intelligence and machine learning capabilities into HMDs amplifies their functionalities, making them more versatile and adaptive to user needs.

Cost is another crucial factor influencing the HMD market. The affordability of these devices has a direct impact on their market penetration. As manufacturing processes evolve and economies of scale are achieved, the cost of producing HMDs decreases, making them more accessible to a larger audience. This cost reduction is particularly significant in consumer markets, fostering widespread adoption.

Regulatory landscape and standards also play a pivotal role in shaping the HMD market. As the technology matures, regulatory bodies establish guidelines and standards to ensure safety, interoperability, and ethical considerations. Compliance with these regulations not only facilitates market entry but also builds consumer trust, contributing to the overall growth of the HMD market.

Global economic conditions and geopolitical factors can influence the HMD market in various ways. Economic stability and growth can positively impact consumer spending on technology, including HMDs. On the other hand, geopolitical tensions and trade disputes can disrupt the supply chain and manufacturing processes, leading to fluctuations in product availability and pricing.

Collaborations and partnerships within the industry are significant market factors for HMDs. Strategic alliances between hardware manufacturers, software developers, and content creators create synergies that drive innovation and broaden the application scope of HMDs. These partnerships can lead to the development of integrated solutions that cater to specific industries or use cases, fostering market expansion.

Consumer preferences and behavior are pivotal factors shaping the HMD market. Understanding and adapting to evolving consumer needs and expectations are crucial for manufacturers and developers. Factors such as design aesthetics, comfort, ease of use, and content availability influence consumer choices, ultimately impacting the success of HMD products in the market.

Leave a Comment