Growth in End-Use Industries

The expansion of various end-use industries is significantly influencing the Hdpe Large Blow Molded Products Market. Sectors such as automotive, consumer goods, and agriculture are increasingly utilizing HDPE products for their durability and versatility. For instance, the automotive industry is adopting HDPE for components due to its lightweight properties, which contribute to fuel efficiency. Similarly, the consumer goods sector is leveraging HDPE for packaging solutions that require strength and resistance to environmental factors. This growth in end-use applications is expected to propel the demand for HDPE products, thereby driving the overall market. As these industries continue to expand, the Hdpe Large Blow Molded Products Market is likely to experience sustained growth.

Customization and Personalization Trends

The trend towards customization is becoming increasingly prominent within the Hdpe Large Blow Molded Products Market. Customers are seeking products that cater to their specific needs and preferences, prompting manufacturers to offer tailored solutions. This demand for personalized products is leading to innovations in design and production techniques, allowing for greater flexibility in product offerings. Companies that can effectively respond to this trend are likely to gain a competitive edge in the market. Data suggests that the customization segment is experiencing robust growth, with consumers willing to pay a premium for products that meet their unique specifications. This shift indicates a significant opportunity for businesses within the Hdpe Large Blow Molded Products Market to enhance customer satisfaction and loyalty.

Rising Demand for Eco-Friendly Packaging

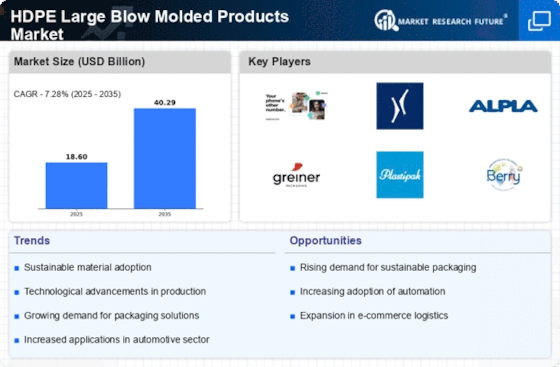

The increasing emphasis on sustainability is driving the Hdpe Large Blow Molded Products Market. Consumers and businesses alike are gravitating towards eco-friendly packaging solutions, which are often made from high-density polyethylene (HDPE). This material is not only recyclable but also has a lower environmental impact compared to alternatives. As a result, manufacturers are investing in HDPE production to meet this growing demand. According to recent data, the market for sustainable packaging is projected to grow significantly, with HDPE products playing a crucial role. This trend indicates a shift in consumer preferences, compelling companies to adapt their product lines to include more environmentally responsible options, thereby enhancing their market position within the Hdpe Large Blow Molded Products Market.

Regulatory Support for Sustainable Materials

Regulatory frameworks promoting the use of sustainable materials are playing a pivotal role in shaping the Hdpe Large Blow Molded Products Market. Governments are increasingly implementing policies that encourage the use of recyclable and environmentally friendly materials, including HDPE. These regulations not only support sustainability initiatives but also create a favorable market environment for manufacturers of HDPE products. Compliance with these regulations can enhance a company's reputation and marketability, as consumers are becoming more conscious of environmental issues. The support from regulatory bodies is expected to drive innovation and investment in the Hdpe Large Blow Molded Products Market, as companies seek to align their operations with sustainability goals.

Technological Innovations in Manufacturing Processes

Technological advancements are reshaping the Hdpe Large Blow Molded Products Market, particularly in manufacturing processes. Innovations such as automation and advanced blow molding techniques are enhancing production efficiency and product quality. These technologies allow for greater precision in the molding process, reducing waste and improving the overall sustainability of production. Furthermore, the integration of smart manufacturing technologies is enabling real-time monitoring and optimization of production lines. As a result, manufacturers can respond more swiftly to market demands and consumer preferences. The adoption of these technologies is expected to drive growth in the Hdpe Large Blow Molded Products Market, as companies seek to improve their operational efficiency and product offerings.