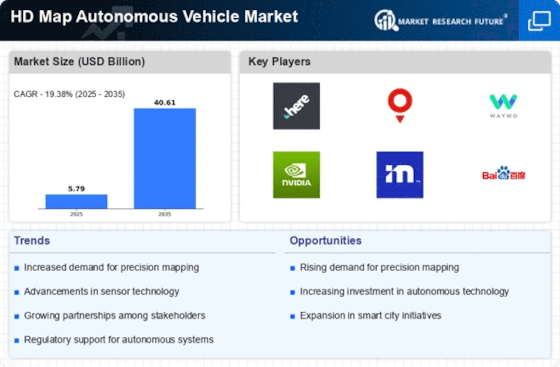

Rising Demand for Autonomous Vehicles

The increasing consumer interest in autonomous vehicles is a primary driver for the HD Map Autonomous Vehicle Market. As safety and convenience become paramount, the demand for vehicles equipped with advanced navigation systems is surging. According to recent estimates, the autonomous vehicle market is projected to reach a valuation of over 800 billion by 2030. This growth is closely tied to the need for high-definition mapping solutions that enhance vehicle perception and decision-making capabilities. Consequently, manufacturers are investing heavily in HD mapping technologies to meet consumer expectations and regulatory requirements. The HD Map Autonomous Vehicle Market is thus experiencing a robust expansion, driven by the necessity for precise and reliable mapping solutions that support the safe operation of autonomous vehicles.

Growing Focus on Safety and Efficiency

The increasing emphasis on safety and operational efficiency in transportation is a vital driver for the HD Map Autonomous Vehicle Market. As stakeholders prioritize reducing accidents and enhancing traffic flow, the demand for advanced mapping solutions is intensifying. HD maps provide critical information that enables autonomous vehicles to navigate complex environments safely. The market is witnessing a shift towards solutions that not only improve safety but also optimize route planning and fuel efficiency. This focus on safety and efficiency is likely to drive investments in HD mapping technologies, as they are integral to the successful deployment of autonomous vehicles. The HD Map Autonomous Vehicle Market is thus positioned to benefit from this growing awareness and commitment to safer transportation solutions.

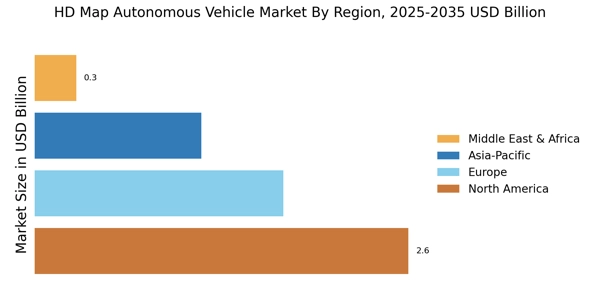

Increased Investment in Smart Infrastructure

The push towards smart infrastructure development is a crucial driver for the HD Map Autonomous Vehicle Market. Governments and private entities are investing in intelligent transportation systems that facilitate the integration of autonomous vehicles into existing road networks. This investment is expected to enhance the overall efficiency and safety of transportation systems. For instance, the implementation of smart traffic signals and connected roadways can provide real-time data to autonomous vehicles, improving their navigation capabilities. As a result, the demand for HD mapping solutions that can support these smart infrastructures is likely to rise. The HD Map Autonomous Vehicle Market stands to gain from this trend, as it aligns with the broader goals of enhancing urban mobility and reducing traffic congestion.

Technological Innovations in Mapping Solutions

Technological advancements in mapping solutions are significantly influencing the HD Map Autonomous Vehicle Market. Innovations such as LiDAR, computer vision, and machine learning are enhancing the accuracy and efficiency of HD maps. These technologies enable the creation of detailed and dynamic maps that can adapt to changing environments. The integration of real-time data from various sources, including sensors and cameras, is becoming increasingly common. This evolution is expected to propel the market forward, as the demand for high-quality mapping solutions is essential for the effective functioning of autonomous vehicles. The HD Map Autonomous Vehicle Market is likely to benefit from these innovations, as they provide the necessary infrastructure for safe and reliable navigation.

Regulatory Support for Autonomous Vehicle Technologies

Regulatory frameworks supporting the development and deployment of autonomous vehicle technologies are emerging as a significant driver for the HD Map Autonomous Vehicle Market. Governments are recognizing the potential benefits of autonomous vehicles, including improved road safety and reduced traffic congestion. As a result, many countries are establishing guidelines and standards for the testing and operation of autonomous vehicles. This regulatory support is likely to create a favorable environment for the adoption of HD mapping technologies, which are essential for compliance with safety standards. The HD Map Autonomous Vehicle Market is expected to thrive as regulations evolve to accommodate the growing presence of autonomous vehicles on the roads.