Stringent Emission Regulations

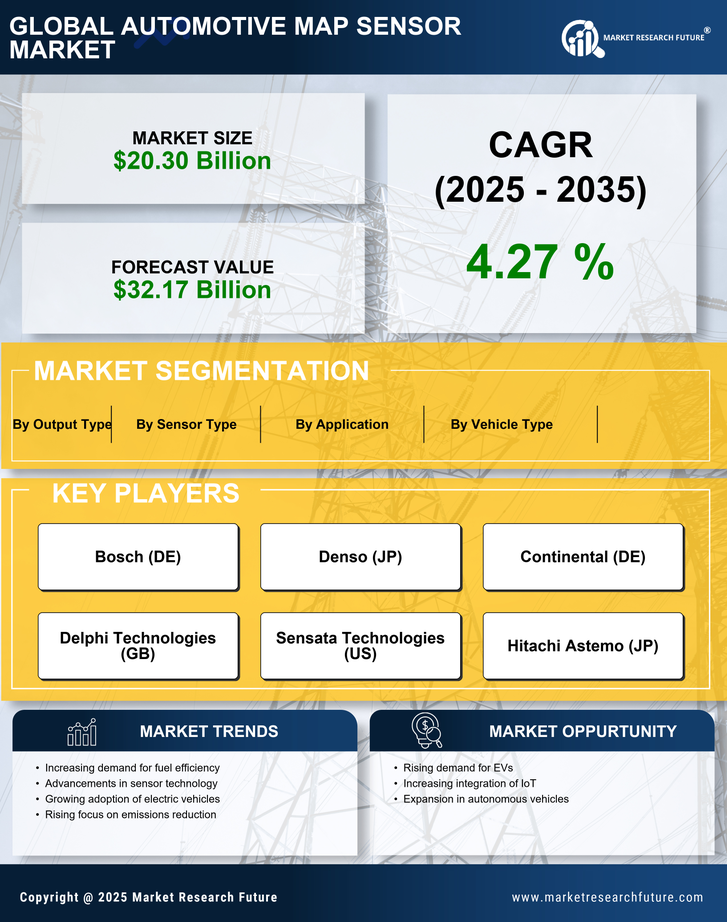

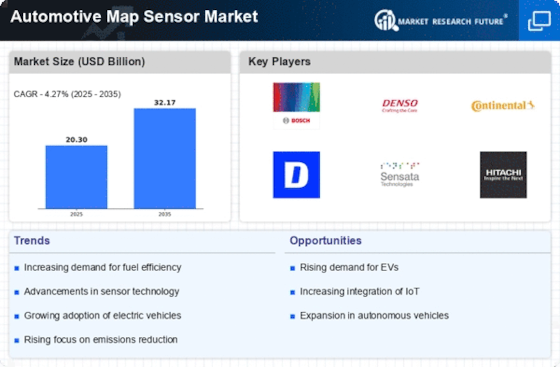

The Automotive Map Sensor Market is significantly influenced by stringent emission regulations imposed by governments worldwide. These regulations aim to reduce harmful emissions from vehicles, compelling manufacturers to adopt advanced technologies, including MAP sensors. These sensors are essential for monitoring and controlling engine parameters, ensuring compliance with emission standards. As regulatory bodies continue to tighten emission norms, the demand for efficient MAP sensors is likely to rise. Recent statistics indicate that the automotive sector must reduce greenhouse gas emissions by 30% by 2030, further propelling the Automotive Map Sensor Market as manufacturers invest in innovative sensor solutions.

Rising Demand for Fuel Efficiency

The Automotive Map Sensor Market is experiencing a notable surge in demand for fuel-efficient vehicles. As consumers become increasingly conscious of fuel costs and environmental impacts, automakers are compelled to enhance vehicle performance through advanced technologies. The integration of manifold absolute pressure (MAP) sensors plays a crucial role in optimizing engine performance, thereby improving fuel efficiency. According to recent data, vehicles equipped with advanced MAP sensors can achieve fuel savings of up to 15%. This trend is likely to drive the Automotive Map Sensor Market as manufacturers seek to meet regulatory standards and consumer expectations for lower emissions and better mileage.

Growth of Electric and Hybrid Vehicles

The Automotive Map Sensor Market is poised for growth due to the rising popularity of electric and hybrid vehicles. These vehicles often require sophisticated sensor technologies to manage powertrains effectively. MAP sensors are integral in optimizing the performance of internal combustion engines, which are still prevalent in hybrid models. As the market for electric and hybrid vehicles expands, the demand for high-quality MAP sensors is expected to increase. Industry forecasts suggest that the hybrid vehicle segment alone could account for a significant share of the Automotive Map Sensor Market, potentially reaching a valuation of several billion dollars by the end of the decade.

Technological Innovations in Sensor Design

The Automotive Map Sensor Market is benefiting from rapid technological innovations in sensor design and functionality. Advances in microelectromechanical systems (MEMS) technology have led to the development of more compact, accurate, and reliable MAP sensors. These innovations enhance the overall performance of vehicles, making them more appealing to consumers. Furthermore, the integration of sensors with vehicle control systems allows for real-time data analysis, improving engine efficiency and performance. As manufacturers continue to innovate, the Automotive Map Sensor Market is expected to witness substantial growth, driven by the demand for high-performance sensors that meet modern automotive requirements.

Increasing Adoption of Advanced Driver Assistance Systems (ADAS)

The Automotive Map Sensor Market is also being propelled by the increasing adoption of Advanced Driver Assistance Systems (ADAS). These systems rely heavily on accurate sensor data to function effectively, and MAP sensors are critical in providing essential information about engine performance and vehicle dynamics. As safety regulations become more stringent and consumer demand for safety features rises, automakers are integrating ADAS into their vehicles. This trend is likely to boost the Automotive Map Sensor Market, as the need for reliable and precise sensors becomes paramount in ensuring the effectiveness of these advanced systems.