North America : Market Leader in Hardware Procurement

North America continues to lead the Hardware Procurement Services market, holding a significant share of 17.5% in 2024. The region's growth is driven by rapid technological advancements, increased demand for cloud computing, and a robust regulatory framework that supports innovation. Companies are increasingly investing in procurement services to enhance operational efficiency and reduce costs, further propelling market growth.

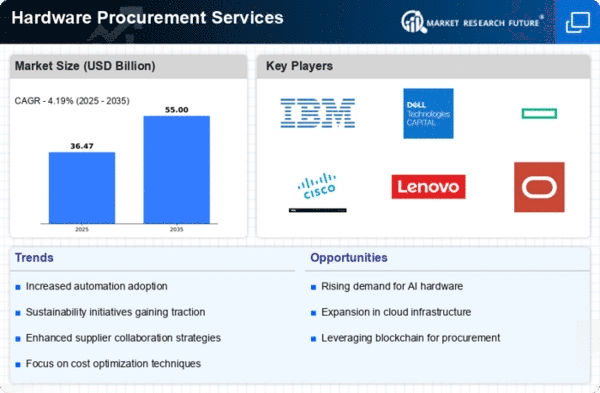

The competitive landscape is characterized by major players such as IBM, Dell Technologies, and Cisco Systems, which dominate the market. The U.S. remains the largest contributor, with a strong focus on enterprise solutions and IT infrastructure. The presence of these key players fosters a dynamic environment, encouraging continuous improvement and innovation in hardware procurement services.

Europe : Emerging Market with Growth Potential

Europe's Hardware Procurement Services market is valued at €10.5 billion, reflecting a growing demand for efficient procurement solutions. The region is witnessing a shift towards digital transformation, driven by regulatory initiatives aimed at enhancing supply chain transparency and sustainability. This regulatory support is crucial for fostering innovation and attracting investments in the sector, contributing to a projected growth trajectory.

Leading countries such as Germany, France, and the UK are at the forefront of this market, with a competitive landscape featuring key players like Hewlett Packard Enterprise and Oracle. The presence of these companies, along with a focus on sustainable practices, positions Europe as a significant player in the global hardware procurement landscape. The region's commitment to innovation and compliance with regulations further enhances its market potential.

Asia-Pacific : Rapid Growth in Emerging Markets

The Asia-Pacific region, valued at $5.5 billion, is experiencing rapid growth in Hardware Procurement Services, driven by increasing digitalization and a burgeoning tech-savvy population. Countries like China and India are leading this growth, supported by government initiatives aimed at enhancing infrastructure and technology adoption. The demand for efficient procurement solutions is further fueled by the rise of e-commerce and cloud services in the region.

The competitive landscape is marked by the presence of key players such as Lenovo and Samsung, which are capitalizing on the growing demand for hardware solutions. The region's diverse market dynamics, coupled with a focus on innovation and cost-effectiveness, position Asia-Pacific as a vital player in The Hardware Procurement Services. The ongoing investments in technology and infrastructure are expected to sustain this growth trajectory.

Middle East and Africa : Emerging Frontier for Hardware Services

The Middle East and Africa region, with a market size of $1.5 billion, is emerging as a frontier for Hardware Procurement Services. The growth is driven by increasing investments in technology and infrastructure, alongside a rising demand for efficient procurement solutions. Regulatory frameworks are gradually evolving to support innovation and attract foreign investments, which is crucial for market expansion in this region.

Countries like South Africa and the UAE are leading the charge, with a competitive landscape that includes both local and international players. The presence of companies such as Oracle and IBM is fostering a dynamic environment, encouraging the adoption of advanced procurement solutions. As the region continues to develop, the focus on technology and efficiency will be key to unlocking its full market potential.