Growing Emphasis on Data Security

Data security has become a paramount concern within the Gym Management Software Market. As gyms increasingly rely on digital solutions to manage sensitive member information, the need for robust security measures has intensified. Recent studies suggest that nearly 60% of fitness facilities prioritize data protection in their software selection process. This emphasis on security is driven by the rising incidence of data breaches and the need to comply with regulations such as GDPR. Consequently, software providers are investing in advanced security features, including encryption and secure payment processing, to meet these demands. The growing emphasis on data security is likely to propel the Gym Management Software Market, as gyms seek reliable solutions to protect their members' information.

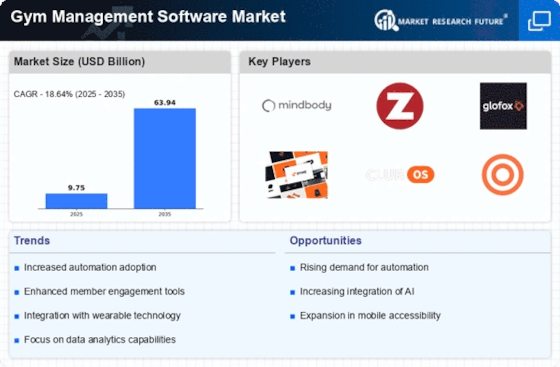

Rising Demand for Fitness Solutions

The Gym Management Software Market is experiencing a notable surge in demand for fitness solutions. As health consciousness rises, more individuals are seeking fitness services, leading to an increase in gym memberships. According to recent data, the fitness industry has seen a growth rate of approximately 8% annually. This trend drives gym owners to adopt management software that can streamline operations, enhance member experiences, and optimize resource allocation. The software enables gyms to manage memberships, schedule classes, and track member progress efficiently. Consequently, the rising demand for fitness solutions is a significant driver for the Gym Management Software Market, as it aligns with the broader trend of prioritizing health and wellness in society.

Shift Towards Subscription-Based Models

The Gym Management Software Market is witnessing a shift towards subscription-based models, which is reshaping revenue streams for fitness facilities. This model allows gyms to offer flexible payment options, making memberships more accessible to a broader audience. Data indicates that subscription-based services have increased member retention rates by approximately 15%, as they provide convenience and affordability. Additionally, gym management software that supports subscription billing can automate payment processes, reducing administrative burdens. This shift not only benefits gym owners but also enhances the overall member experience, as individuals can easily manage their subscriptions online. Consequently, the transition to subscription-based models serves as a key driver for the Gym Management Software Market.

Increased Competition Among Fitness Facilities

The Gym Management Software Market is significantly influenced by the increased competition among fitness facilities. As more gyms enter the market, there is a pressing need for differentiation through enhanced services and member experiences. This competitive landscape compels gym owners to adopt sophisticated management software that can streamline operations and provide valuable insights into member preferences. Data indicates that gyms utilizing management software can improve operational efficiency by up to 30%, allowing them to focus on member engagement and retention strategies. As competition intensifies, the demand for innovative software solutions that can provide a competitive edge is likely to drive growth in the Gym Management Software Market.

Technological Advancements in Software Solutions

Technological advancements are profoundly influencing the Gym Management Software Market. Innovations such as artificial intelligence, machine learning, and mobile applications are transforming how gyms operate. These technologies facilitate personalized member experiences, automate administrative tasks, and provide data-driven insights for better decision-making. For instance, AI-driven analytics can help gym owners understand member behavior and preferences, leading to tailored marketing strategies. The integration of these advanced technologies is expected to propel the market forward, as gyms increasingly seek software solutions that enhance operational efficiency and member satisfaction. As a result, the Gym Management Software Market is likely to witness substantial growth driven by these technological advancements.