Advancements in Telecommunications

The Graphene Electronic Market is experiencing growth due to advancements in telecommunications technology. As the demand for faster and more reliable communication networks escalates, graphene's unique properties are being leveraged to enhance telecommunications infrastructure. Graphene-based materials can improve signal transmission and reduce energy consumption in communication devices. With the telecommunications market projected to exceed USD 2 trillion by 2025, the integration of graphene into this sector could lead to significant improvements in network performance. This trend not only supports the expansion of the Graphene Electronic Market but also aligns with the increasing need for efficient communication solutions in a connected world.

Growing Interest in Sustainable Materials

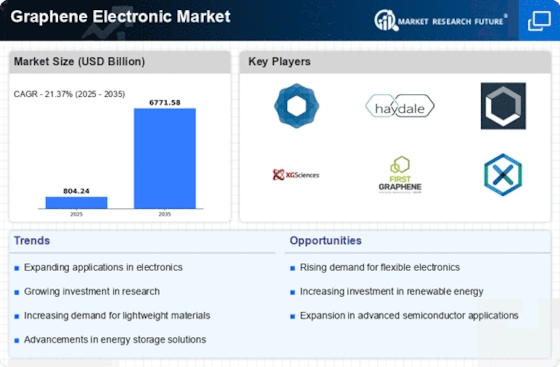

The Graphene Electronic Market is benefiting from the growing interest in sustainable materials. As environmental concerns become more pressing, industries are seeking alternatives to traditional materials that are often less eco-friendly. Graphene, derived from carbon, is not only abundant but also offers a lower environmental impact during production compared to conventional materials. This shift towards sustainability is reflected in the increasing investments in graphene research and development, with funding reaching millions of dollars annually. Companies are exploring graphene's potential in various applications, from energy-efficient devices to biodegradable electronics, thereby expanding the Graphene Electronic Market and aligning with global sustainability goals.

Increasing Adoption of Wearable Technology

The Graphene Electronic Market is experiencing a notable surge in the adoption of wearable technology. This trend is driven by the demand for lightweight, flexible, and durable materials that graphene offers. Wearable devices, such as smartwatches and fitness trackers, require advanced materials to enhance performance and user experience. Graphene's unique properties, including high conductivity and mechanical strength, make it an ideal candidate for these applications. As the wearable technology market is projected to reach USD 100 billion by 2026, the Graphene Electronic Market stands to benefit significantly from this growth. The integration of graphene into these devices could lead to improved battery life and enhanced functionalities, thereby attracting more consumers and driving market expansion.

Rising Demand for Advanced Energy Solutions

The Graphene Electronic Market is witnessing a rising demand for advanced energy solutions, particularly in the context of energy storage and conversion technologies. Graphene's high surface area and conductivity make it an attractive material for batteries and supercapacitors, which are essential for renewable energy applications. As the energy storage market is expected to grow to USD 200 billion by 2026, the Graphene Electronic Market is likely to play a crucial role in this transformation. The development of graphene-based energy solutions could lead to faster charging times and longer-lasting energy storage systems, thereby meeting the increasing energy demands of consumers and industries alike.

Enhanced Performance in Electronic Components

The Graphene Electronic Market is poised for growth due to the enhanced performance characteristics that graphene provides in electronic components. Graphene's exceptional electrical conductivity and thermal properties enable the development of faster and more efficient transistors, sensors, and other electronic devices. As the demand for high-performance electronics continues to rise, manufacturers are increasingly turning to graphene to meet these needs. The semiconductor market, valued at approximately USD 500 billion, is likely to see a shift towards graphene-based components, which could revolutionize the industry. This transition not only promises improved device performance but also opens new avenues for innovation within the Graphene Electronic Market.

.png)