Regulatory Changes and Compliance

The Grain Fumigant Market is significantly impacted by evolving regulatory frameworks aimed at ensuring safe and effective use of fumigants. Governments are increasingly implementing stringent regulations to mitigate environmental and health risks associated with fumigation. Compliance with these regulations is essential for market players, as non-compliance can lead to severe penalties and loss of market access. Consequently, companies are investing in research and development to create fumigants that meet regulatory standards while maintaining efficacy. This trend is expected to drive innovation within the Grain Fumigant Market, as stakeholders strive to balance safety and effectiveness in their fumigation practices.

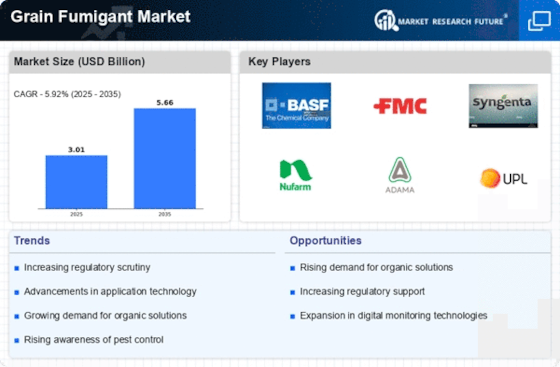

Increasing Demand for Food Security

The Grain Fumigant Market is experiencing a surge in demand driven by the global emphasis on food security. As populations grow, the need to protect stored grains from pests and diseases becomes paramount. This is particularly evident in regions where agricultural production is challenged by climatic conditions. The market is projected to grow at a compound annual growth rate of approximately 5.2% over the next few years, reflecting the urgency to maintain grain quality and minimize losses. Stakeholders in the Grain Fumigant Market are increasingly focusing on effective fumigation solutions to ensure that food supply chains remain intact, thereby addressing the critical issue of food wastage.

Rising Awareness of Pest Resistance

The Grain Fumigant Market is witnessing heightened awareness regarding pest resistance, which is influencing fumigation practices. As certain pests develop resistance to conventional pesticides, the need for effective fumigants becomes more pronounced. This awareness is prompting farmers and grain handlers to seek advanced fumigation solutions that can effectively manage resistant pest populations. The market is likely to see an increase in the adoption of innovative fumigants that offer broader efficacy against a range of pests. This shift not only enhances pest management strategies but also aligns with sustainable agricultural practices, thereby fostering growth within the Grain Fumigant Market.

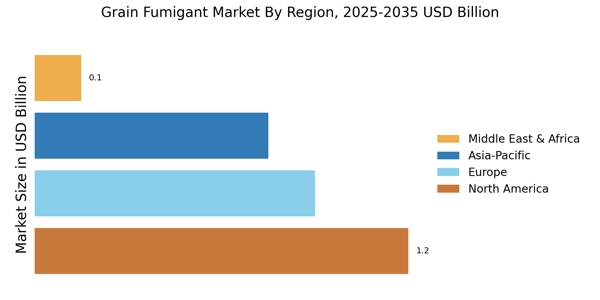

Growing Export Opportunities for Grains

The Grain Fumigant Market is poised for growth due to expanding export opportunities for grains. As countries seek to enhance their agricultural exports, maintaining the quality of stored grains becomes crucial. Fumigation plays a vital role in ensuring that grains meet international quality standards, thereby facilitating smoother trade. The increasing demand for grains in emerging markets is likely to drive the need for effective fumigation solutions. This trend presents a significant opportunity for stakeholders in the Grain Fumigant Market to develop tailored fumigation strategies that cater to the specific requirements of different export markets, ultimately enhancing their competitive edge.

Technological Innovations in Fumigation Techniques

The Grain Fumigant Market is benefiting from technological innovations that enhance fumigation techniques. Advancements in application methods, such as the use of drones and automated systems, are improving the efficiency and precision of fumigation processes. These technologies not only reduce labor costs but also minimize the environmental impact of fumigants. As a result, the market is likely to see increased adoption of these innovative techniques, which can lead to better pest control outcomes. Furthermore, the integration of data analytics and monitoring systems is enabling stakeholders to optimize fumigation schedules and improve overall grain storage management within the Grain Fumigant Market.