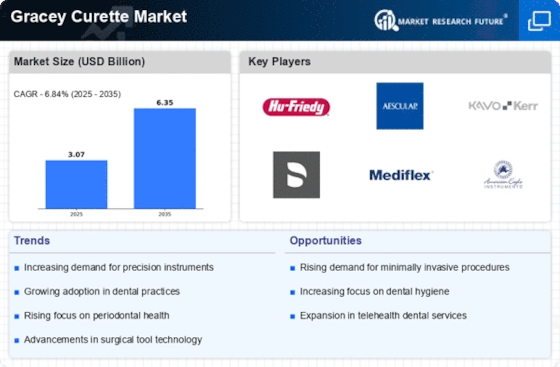

Rising Demand for Dental Procedures

The increasing prevalence of dental diseases and the rising awareness regarding oral hygiene are driving the Gracey Curette Market. As more individuals seek dental care, the demand for specialized instruments like Gracey curettes is likely to rise. According to recent data, dental procedures have seen a steady increase, with a projected growth rate of approximately 5% annually. This trend suggests that dental professionals are increasingly utilizing Gracey curettes for their effectiveness in periodontal treatments. The growing emphasis on preventive care further fuels this demand, as practitioners aim to provide comprehensive solutions for their patients. Consequently, the Gracey Curette Market is positioned to benefit from this upward trajectory in dental care utilization.

Growing Awareness of Periodontal Health

The rising awareness of periodontal health is a crucial driver for the Gracey Curette Market. As educational initiatives and public health campaigns highlight the importance of maintaining gum health, more individuals are seeking preventive and therapeutic dental care. This trend is reflected in the increasing number of periodontal treatments performed annually, which has been reported to rise by approximately 4% in recent years. Dental professionals are increasingly utilizing Gracey curettes for their precision in scaling and root planing procedures. This heightened focus on periodontal health not only boosts the demand for Gracey curettes but also encourages practitioners to invest in high-quality instruments. Thus, the Gracey Curette Market stands to gain from this growing emphasis on oral health education.

Increased Focus on Preventive Dentistry

The increased focus on preventive dentistry is a significant driver for the Gracey Curette Market. As dental professionals emphasize the importance of early intervention and regular check-ups, the demand for effective tools like Gracey curettes is likely to rise. Preventive dentistry aims to reduce the incidence of dental diseases, which in turn drives the need for instruments that facilitate thorough cleaning and maintenance of oral health. Data suggests that preventive dental visits have increased by approximately 5% annually, indicating a shift in patient behavior towards proactive care. This trend not only enhances the utilization of Gracey curettes but also positions the Gracey Curette Market favorably in the evolving landscape of dental care.

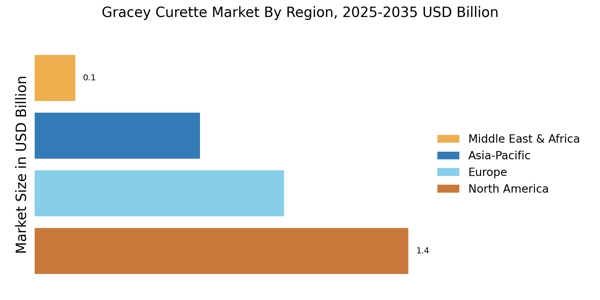

Expansion of Dental Clinics and Practices

The expansion of dental clinics and practices is contributing to the growth of the Gracey Curette Market. As more dental professionals establish their practices, the demand for specialized instruments, including Gracey curettes, is likely to increase. Recent statistics indicate that the number of dental clinics has grown by approximately 6% over the past few years, reflecting a broader trend towards accessible dental care. This proliferation of clinics creates a larger market for dental instruments, as practitioners seek to equip their facilities with the necessary tools for effective treatment. Consequently, the Gracey Curette Market is poised to benefit from this expansion, as new clinics require high-quality instruments to meet the needs of their patients.

Technological Innovations in Dental Instruments

Technological advancements in dental instruments are significantly influencing the Gracey Curette Market. Innovations such as improved materials and ergonomic designs enhance the functionality and user experience of Gracey curettes. For instance, the introduction of stainless steel and titanium alloys has improved the durability and effectiveness of these instruments. Furthermore, the integration of digital technologies in dental practices is likely to streamline procedures, making the use of Gracey curettes more efficient. As dental professionals increasingly adopt these advanced tools, the market for Gracey curettes is expected to expand. The ongoing research and development in dental technology indicate a promising future for the Gracey Curette Market, as practitioners seek to enhance patient outcomes through superior instruments.