Cost Efficiency and Budget Optimization

Cost efficiency remains a pivotal driver in the Government Cloud Market. Governments are under constant pressure to optimize budgets while maintaining service quality. Cloud solutions offer a pay-as-you-go model, which allows agencies to reduce capital expenditures and shift to operational spending. This financial flexibility is particularly appealing in an era where fiscal constraints are prevalent. Reports suggest that agencies utilizing cloud services can achieve cost savings of up to 30% compared to traditional IT infrastructure. As such, the drive for budget optimization is likely to propel further investments in cloud technologies, fostering a competitive landscape within the Government Cloud Market.

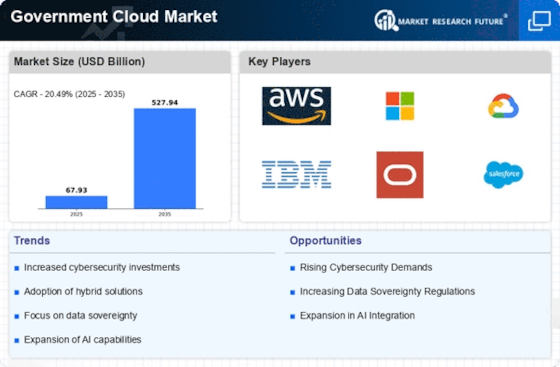

Regulatory Compliance and Data Sovereignty

The Government Cloud Market is increasingly influenced by the need for regulatory compliance and data sovereignty. Governments are mandated to adhere to strict regulations regarding data storage and processing, which necessitates the use of cloud solutions that comply with local laws. This has led to a surge in demand for cloud services that ensure data remains within national borders, thereby enhancing security and trust. As of 2025, it is estimated that over 70% of government agencies prioritize compliance when selecting cloud providers. This trend indicates a robust growth trajectory for the Government Cloud Market, as agencies seek solutions that align with their legal obligations while also providing the flexibility and scalability required for modern operations.

Enhanced Collaboration and Interoperability

The need for enhanced collaboration and interoperability among government agencies is a significant driver in the Government Cloud Market. Cloud solutions facilitate seamless communication and data sharing across various departments, which is essential for effective governance. As agencies increasingly adopt cloud-based platforms, the ability to collaborate in real-time becomes a critical factor in improving service delivery. Current trends indicate that over 60% of government entities are prioritizing interoperability in their cloud strategies. This focus on collaboration not only streamlines operations but also enhances the overall efficiency of public services, thereby reinforcing the demand for cloud solutions in the Government Cloud Market.

Focus on Disaster Recovery and Business Continuity

The emphasis on disaster recovery and business continuity planning is a crucial driver in the Government Cloud Market. Governments are increasingly recognizing the importance of maintaining operations during unforeseen events, such as natural disasters or cyberattacks. Cloud solutions provide robust disaster recovery capabilities, ensuring that critical data and applications remain accessible even in adverse conditions. Current estimates suggest that approximately 50% of government agencies are prioritizing cloud-based disaster recovery solutions in their IT strategies. This focus on resilience not only safeguards public services but also enhances the overall reliability of government operations, thereby fueling demand within the Government Cloud Market.

Emergence of Artificial Intelligence and Automation

The integration of artificial intelligence and automation technologies is transforming the Government Cloud Market. These advanced technologies enable government agencies to enhance operational efficiency, improve decision-making, and deliver better services to citizens. As of 2025, it is projected that nearly 40% of government cloud deployments will incorporate AI-driven solutions. This shift indicates a growing recognition of the potential benefits of automation in streamlining processes and reducing manual workloads. Consequently, the adoption of AI and automation is likely to drive further investments in cloud infrastructure, positioning the Government Cloud Market for substantial growth in the coming years.