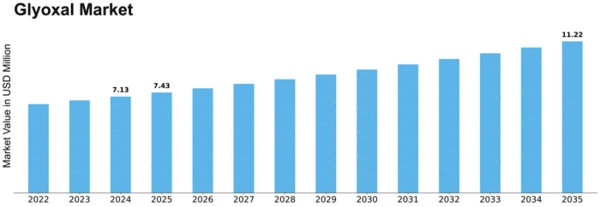

Glyoxal Size

Glyoxal Market Growth Projections and Opportunities

Glyoxal market dynamics are shaped by multiple market factors. Textile, paper, and oil and gas demand are major drivers.Glyoxal is in high demand because it improves fabric qualities including wrinkle resistance and colorfastness in the textile industry.

The Glyoxal market is heavily influenced by regulations, especially in textile and paper applications. Glyoxal formulation and use are influenced by environmental and safety criteria, including formaldehyde levels and emissions. To secure product approval in crucial applications, manufacturers in this market focus on meeting strict regulatory standards.

Economic conditions worldwide affect the Glyoxal market. Glyoxal demand rises with economic expansion, industrialization, and consumer expenditure. In industries dependent on consumer spending on textiles, paper, and similar items, economic downturns may temporarily alter market dynamics.

Glyoxal market growth depends on innovation and technology. Glyoxal's performance and use in numerous industries are improved by ongoing research into new formulations and applications. Innovation gives manufacturers a competitive edge by supplying advanced solutions to meet industries' changing needs for process efficiency and performance.

The Glyoxal market depends on raw material prices and availability. The main raw material for glyoxal manufacturing is glycol, therefore price variations might affect production costs. For market stability and competitiveness, manufacturers must carefully manage their raw material supply chains. Glyoxal makers compete fiercely for market share. Product quality, consistency, and cost-effectiveness distinguish companies.

Geopolitics also influence Glyoxal sales. Tariffs, trade policies, and geopolitics affect global supply chains and markets. Manufacturers must monitor international trade circumstances to avoid interruptions and position themselves successfully in the market.

Glyoxal benefit awareness and customer preferences drive market developments. Textile and paper industries demand glyoxal for cross-linking. Manufacturers adapt to changing customer preferences by creating products with distinct features for different uses.

Leave a Comment