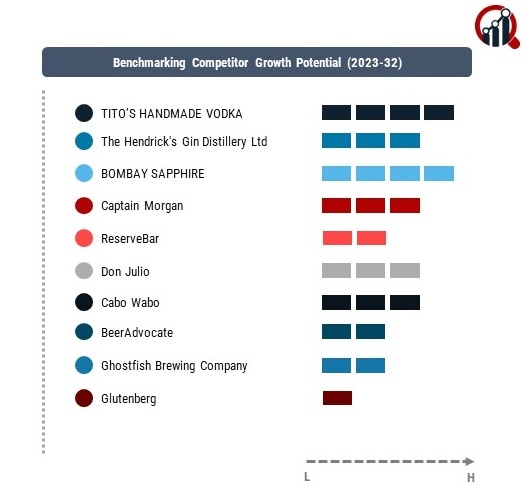

Top Industry Leaders in the Gluten Free Alcoholic Drinks Market

The competitive landscape of the Gluten-Free Alcoholic Drinks market is marked by a dynamic interplay of key players, strategic maneuvers, and emerging trends, shaping the industry's trajectory. Key players such as Anheuser-Busch InBev, Daura Damm, and Omission Brewing Company dominate the market with a diverse range of gluten-free beer offerings, capitalizing on the growing demand for alternatives catering to gluten-sensitive consumers. These industry giants deploy strategies like product innovation, partnerships, and acquisitions to solidify their market positions.

Strategies employed:

In response to the rising gluten-free trend, Anheuser-Busch InBev, a global brewing powerhouse, has strategically expanded its gluten-free beer portfolio. By investing in research and development, the company aims to create flavorful gluten-free options, addressing consumer preferences while maintaining quality. Collaborative ventures with gluten-free product manufacturers further augment their presence in this niche market segment.

Daura Damm, renowned for its gluten-free beer, continues to invest in technological advancements and sustainable brewing practices. The company's commitment to quality and gluten-free purity has propelled its market share, positioning it as a frontrunner in the gluten-free alcoholic drinks space. Daura Damm's emphasis on marketing campaigns and consumer education has also contributed to heightened brand visibility and loyalty.

Omission Brewing Company, specializing in gluten-removed beers, employs a unique brewing process to eliminate gluten while retaining the traditional beer taste. This innovative approach has garnered a dedicated consumer base seeking a gluten-free experience without compromising on flavor. Omission Brewing Company's strategic distribution alliances and promotional initiatives further bolster its competitive edge.

factors for market share analysis:

Market share analysis in the gluten-free alcoholic drinks sector considers various factors, including product quality, distribution channels, pricing strategies, and consumer preferences. As gluten awareness grows, companies focusing on transparent labeling and certification of gluten-free products gain a competitive advantage. The ability to adapt to evolving consumer trends, such as the demand for organic and locally sourced ingredients, plays a pivotal role in maintaining or expanding market share.

emerging companies:

New and emerging companies are making noteworthy strides in this market, challenging established players with innovative offerings. Start-ups like Glutenberg and Holidaily Brewing Company are gaining prominence by introducing unique gluten-free beer varieties and leveraging niche marketing strategies. Glutenberg, for instance, has carved a niche by crafting gluten-free beers that resonate with the craft beer movement, appealing to a discerning consumer base seeking artisanal alternatives.

industry news:

Industry news indicates a growing interest in gluten-free alcoholic drinks, with notable partnerships, acquisitions, and investments shaping the market landscape. Collaborations between breweries and gluten-free ingredient suppliers aim to enhance product quality and expand market reach. Mergers and acquisitions facilitate market consolidation, allowing companies to diversify their product portfolios and leverage synergies for accelerated growth.

In 2023, notable developments include the entry of major spirit distillers into the gluten-free space. Recognizing the demand for gluten-free options extends beyond beer, distillers such as Diageo and Pernod Ricard are introducing gluten-free spirits. This expansion broadens the market's scope, providing consumers with diverse choices in the alcoholic beverage category. These developments align with the overarching industry trend of inclusivity, ensuring individuals with gluten sensitivities have a wide array of options across different alcohol categories.

Current company investment trends in the gluten-free alcoholic drinks market underscore the significance of sustainability and corporate social responsibility. Leading companies are increasingly investing in eco-friendly packaging, energy-efficient production processes, and community engagement initiatives. These initiatives not only contribute to brand image but also resonate with environmentally conscious consumers, creating a positive feedback loop that enhances market presence.

The overall competitive scenario in the gluten-free alcoholic drinks market is characterized by a balance between established players, innovative newcomers, and strategic collaborations. As consumer awareness of gluten sensitivity continues to rise, the market is poised for sustained growth. The success of companies hinges on their ability to adapt, innovate, and meet evolving consumer expectations in this dynamic and expanding segment of the alcoholic beverage industry.

Key Companies in the Gluten Free Alcoholic Drinks market include

TITO’S HANDMADE VODKA

The Hendrick's Gin Distillery Ltd

BOMBAY SAPPHIRE

Captain Morgan

ReserveBar

Don Julio

Cabo Wabo

BeerAdvocate

Ghostfish Brewing Company

Glutenberg