Regulatory Compliance

Regulatory compliance is a critical driver in the Global Alcoholic Drinks Packaging Market Industry. Governments worldwide are implementing stringent regulations regarding labeling, safety, and environmental impact of packaging materials. Compliance with these regulations is essential for manufacturers to avoid penalties and maintain market access. For example, the European Union has introduced directives aimed at reducing single-use plastics, compelling companies to innovate in their packaging strategies. This regulatory landscape not only influences material choices but also encourages investment in sustainable packaging solutions, thereby shaping the future of the industry.

Market Growth Projections

The Global Alcoholic Drinks Packaging Market Industry is poised for substantial growth, with projections indicating a market size of 41.6 USD Billion in 2024 and an anticipated increase to 55.4 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 2.64% from 2025 to 2035. Such figures underscore the resilience and adaptability of the industry in response to evolving consumer demands and regulatory landscapes. The market's expansion is likely to be fueled by innovations in packaging technologies, sustainability initiatives, and the increasing globalization of alcoholic beverages.

Sustainability Initiatives

The Global Alcoholic Drinks Packaging Market Industry is increasingly influenced by sustainability initiatives. Consumers are gravitating towards eco-friendly packaging options, prompting manufacturers to adopt biodegradable materials and recyclable designs. This shift not only addresses environmental concerns but also aligns with regulatory pressures aimed at reducing plastic waste. For instance, brands are exploring plant-based plastics and lightweight glass alternatives, which can significantly lower carbon footprints. As a result, the market is projected to reach 41.6 USD Billion in 2024, reflecting a growing commitment to sustainable practices in packaging.

Technological Advancements

Technological advancements play a pivotal role in shaping the Global Alcoholic Drinks Packaging Market Industry. Innovations such as smart packaging, which incorporates QR codes and NFC technology, enhance consumer engagement and provide product information. These technologies enable brands to connect with consumers on a deeper level, fostering brand loyalty. Moreover, automation in packaging processes increases efficiency and reduces costs. As the industry embraces these technologies, it is anticipated that the market will experience a compound annual growth rate of 2.64% from 2025 to 2035, indicating a robust evolution driven by technological integration.

Changing Consumer Preferences

Changing consumer preferences significantly impact the Global Alcoholic Drinks Packaging Market Industry. There is a noticeable trend towards premiumization, with consumers willing to pay more for high-quality, aesthetically pleasing packaging. This shift is evident in the craft beer and artisanal spirits segments, where unique packaging designs serve as a key differentiator. Additionally, the rise of e-commerce has necessitated packaging solutions that ensure product safety during transit while maintaining visual appeal. As these preferences evolve, the market is expected to grow to 55.4 USD Billion by 2035, reflecting the importance of packaging in consumer decision-making.

Globalization of Alcoholic Beverages

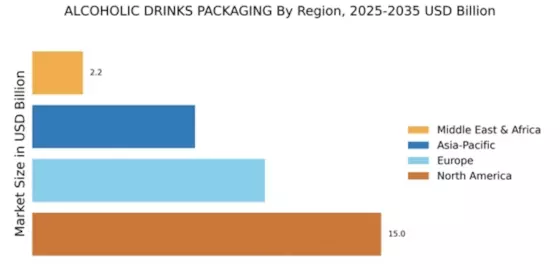

The globalization of alcoholic beverages significantly influences the Global Alcoholic Drinks Packaging Market Industry. As brands expand their reach into international markets, packaging becomes a crucial element in appealing to diverse consumer bases. Packaging must not only comply with local regulations but also resonate with cultural preferences and aesthetics. This globalization trend has led to an increase in demand for versatile packaging solutions that can cater to various markets. Consequently, the industry is witnessing a surge in innovative designs and materials that enhance product visibility and appeal, further driving market growth.