Rising Demand in Food Industry

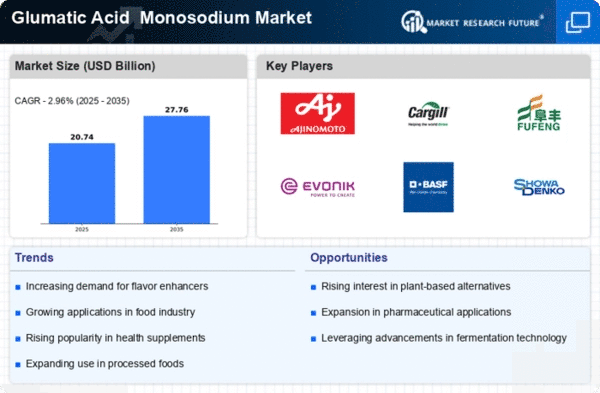

The Global Glumatic Acid and Monosodium Market Industry experiences a notable surge in demand driven by the food sector. Glutamic acid, primarily used as a flavor enhancer, is increasingly incorporated into processed foods, snacks, and seasonings. In 2024, the market is projected to reach 20.1 USD Billion, reflecting the growing consumer preference for umami flavors. This trend is further supported by the expansion of the food processing industry, particularly in emerging economies, where urbanization and changing dietary habits are influencing consumption patterns. As a result, the industry is likely to witness sustained growth, with glutamic acid becoming a staple ingredient in various culinary applications.

Health and Nutritional Benefits

The Global Glumatic Acid and Monosodium Market Industry is also propelled by the increasing awareness of health and nutritional benefits associated with glutamic acid. It is recognized for its role in protein synthesis and its potential to enhance cognitive function. As consumers become more health-conscious, the demand for products containing glutamic acid is expected to rise. This trend is particularly evident in dietary supplements and functional foods, where glutamic acid is marketed for its potential benefits. The industry's growth trajectory is likely to be influenced by ongoing research and development efforts aimed at highlighting these benefits, thereby attracting a broader consumer base.

Emerging Markets and Globalization

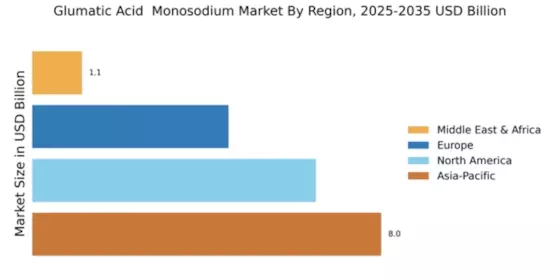

Emerging markets play a crucial role in the growth of the Global Glumatic Acid and Monosodium Market Industry. As globalization continues to influence trade and consumer preferences, countries in Asia-Pacific and Latin America are witnessing a rise in demand for glutamic acid and monosodium. The increasing middle-class population in these regions is driving consumption patterns towards processed foods and flavor enhancers. This trend is expected to contribute to a compound annual growth rate of 2.96% from 2025 to 2035, highlighting the potential for market expansion. Manufacturers are likely to focus on these regions to capitalize on the growing consumer base and enhance their market presence.

Expanding Application in Pharmaceuticals

The Global Glumatic Acid and Monosodium Market Industry is witnessing an expanding application of glutamic acid in the pharmaceutical sector. Its utilization in drug formulation and as an excipient is becoming increasingly prevalent, driven by its properties as a stabilizer and flavoring agent. The pharmaceutical industry's growth, particularly in developing regions, is likely to create new opportunities for glutamic acid and monosodium. As healthcare systems evolve and the demand for innovative drug delivery systems increases, the industry may experience a shift in focus towards pharmaceutical applications, thereby diversifying its market base and enhancing revenue streams.

Technological Advancements in Production

Technological advancements in the production of glutamic acid and monosodium are significantly influencing the Global Glumatic Acid and Monosodium Market Industry. Innovations in fermentation technology and enzymatic processes have led to more efficient production methods, reducing costs and enhancing yield. These advancements not only improve the sustainability of production but also cater to the increasing demand for high-quality products. As a result, manufacturers are better positioned to meet market needs while maintaining competitive pricing. The industry is expected to benefit from these technological improvements, which may contribute to a projected market value of 27.8 USD Billion by 2035.