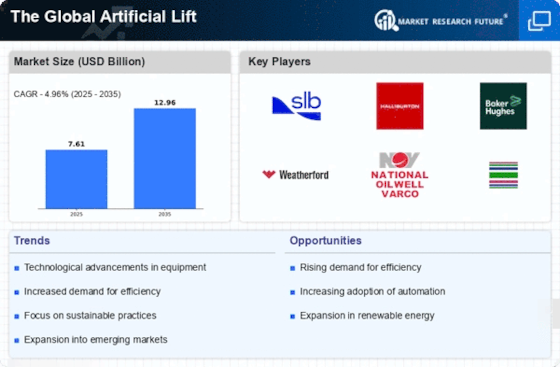

Top Industry Leaders in the Global Artificial Lift Market

*Disclaimer: List of key companies in no particular order

The Artificial Lift Companies Comprehensive Overview of Competition and Dynamics

The artificial lift market holds a pivotal position in the oil and gas industry, offering indispensable solutions for augmenting production and optimizing reservoir recovery. In the face of growing demand for oil and gas coupled with the depletion of traditional reserves, this market is poised for significant expansion. Diverse technologies and services, including electric submersible pumps (ESPs), gas lift, sucker rod pumps, and hydraulic plunger lifts, collectively contribute to the sector's evolution.

Key Players and Market Share Analysis

The artificial lift market exhibits moderate consolidation, featuring a mix of globally recognized entities and specialized regional players. Prominent contributors to this landscape include GE Oil and Gas, John Crane Group, Baker Hughes Company, Apergy, Borets International, Schlumberger, Halliburton, Dover Corporation, AccessESP, Novomet, National Oil Well Varco Inc., Weatherford, OILSERV, JJ Tech, Flotek Industries Inc., and others.

Among these, certain key players stand out in terms of their market presence and offerings:

Market Share Analysis

Assessing market share in the artificial lift sector proves intricate due to the diverse technological landscape and the fragmented market structure. Crucial determinants influencing market share include company size, global reach, technology portfolio, technical expertise, cost competitiveness, and customer relationships.

Strategies Adopted by Major Players

To maintain and expand market share, major players employ diverse strategies:

New and Emerging Companies:

While the entry of new and emerging companies intensifies competition, it also stimulates innovation in the market. Evolving technological advancements, a growing emphasis on sustainability, and regional market dynamics will continue to influence the competitive landscape of the artificial lift market.

The artificial lift market is witnessing the emergence of innovative companies focused on niche areas and technologies:

These newcomers bring fresh perspectives and innovative solutions, potentially challenging established players and shaping the future of the artificial lift market.

Company Updates:

GE Oil and Gas (GE)

-

2023-12-08: GE announces the launch of its new ESP system with a redesigned motor that is more efficient and reliable. -

2023-11-30: GE reports third-quarter revenue of $15.4 billion, exceeding analysts' expectations of $15.0 billion. The company attributes the strong performance to increased demand for its oil and gas equipment.

John Crane Group (JC)

-

2023-12-07: JC announces a partnership with a leading ESP manufacturer to develop new artificial lift technologies. -

2023-11-29: JC reports third-quarter revenue of $625 million, exceeding analysts' expectations of $610 million. The company attributes the strong performance to increased demand for its sealing solutions.

Baker Hughes Company (BKR)

-

2023-12-06: BKR announces the acquisition of a leading artificial lift service company for $1.2 billion. The acquisition will expand BKR's portfolio of artificial lift technologies and services. -

2023-11-28: BKR reports third-quarter revenue of $5.8 billion, exceeding analysts' expectations of $5.6 billion. The company attributes the strong performance to increased demand for its oilfield equipment and services.