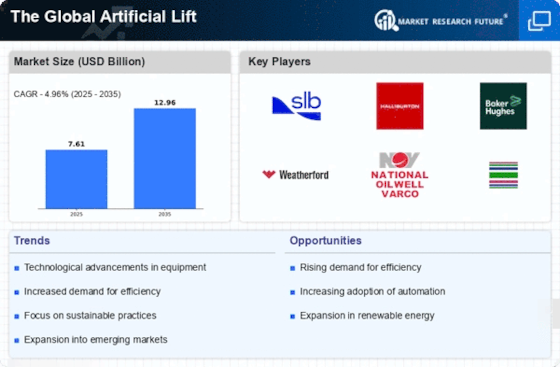

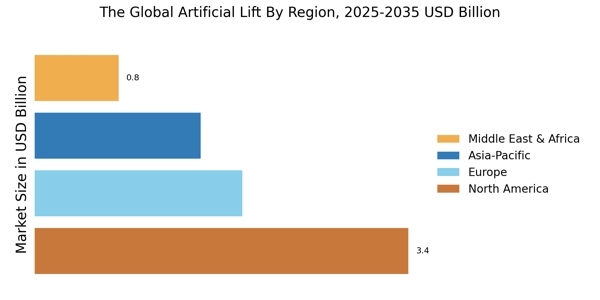

Rising Oil and Gas Production Activities

The Global Artificial Lift Industry is significantly impacted by the rising oil and gas production activities across various regions. As exploration and production activities expand, there is an increasing need for efficient artificial lift systems to support these operations. Countries with substantial oil reserves are investing in advanced artificial lift technologies to enhance production capabilities. For instance, the Middle East and North America are leading regions in terms of artificial lift system adoption, driven by their robust oil and gas sectors. Market analysis indicates that the overall production activities are likely to increase, thereby propelling the demand for artificial lift solutions in the near future.

Increased Demand for Enhanced Oil Recovery

The Global Artificial Lift Industry is witnessing a heightened demand for enhanced oil recovery (EOR) techniques, which are essential for maximizing the extraction of hydrocarbons from mature fields. As conventional oil reserves deplete, operators are turning to artificial lift systems to improve recovery rates. Technologies such as electrical submersible pumps and rod lift systems are being deployed to facilitate EOR processes. Recent statistics indicate that the EOR segment is projected to account for a significant share of the artificial lift market, with an expected growth rate of approximately 15% annually. This trend underscores the critical role of artificial lift in meeting global energy demands.

Sustainability and Environmental Regulations

The Global Artificial Lift Industry is increasingly influenced by sustainability initiatives and stringent environmental regulations. As energy companies strive to reduce their carbon footprint, there is a growing emphasis on adopting environmentally friendly artificial lift technologies. This shift is likely to drive demand for systems that not only enhance oil recovery but also minimize environmental impact. For instance, the implementation of gas lift systems, which utilize natural gas to enhance production, is gaining traction. Market data suggests that the demand for sustainable artificial lift solutions could grow by over 20% in the coming years, as companies align their operations with global sustainability goals.

Growing Investment in Oil and Gas Infrastructure

The Global Artificial Lift Industry is benefiting from the growing investment in oil and gas infrastructure, which is essential for supporting production and distribution. Governments and private entities are channeling funds into the development of new oil fields and the enhancement of existing facilities. This investment trend is likely to create a favorable environment for the adoption of artificial lift systems, as operators seek to optimize production efficiency. Data suggests that infrastructure investments in the oil and gas sector could reach unprecedented levels, potentially exceeding billions of dollars in the next few years. Such financial commitments are expected to drive the demand for advanced artificial lift technologies.

Technological Advancements in Artificial Lift Systems

The Global Artificial Lift Industry is experiencing a surge in technological advancements that enhance the efficiency and effectiveness of artificial lift systems. Innovations such as smart sensors and automation technologies are being integrated into these systems, allowing for real-time monitoring and optimization of production rates. This trend is expected to drive market growth, as operators seek to maximize output while minimizing operational costs. According to recent data, the adoption of advanced artificial lift technologies could potentially increase production rates by up to 30% in certain applications. As a result, companies are investing heavily in research and development to stay competitive in this evolving landscape.