Glass Packaging Size

Market Size Snapshot

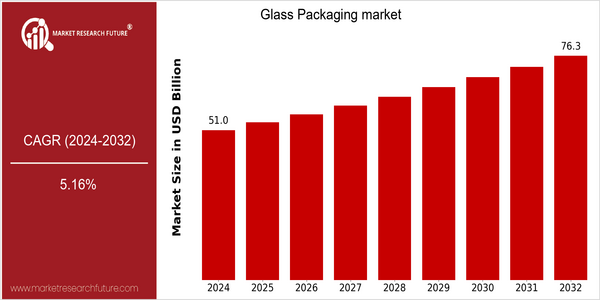

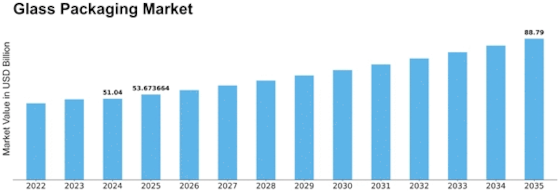

| Year | Value |

|---|---|

| 2024 | USD 51.04 Billion |

| 2032 | USD 76.35 Billion |

| CAGR (2024-2032) | 5.16 % |

Note – Market size depicts the revenue generated over the financial year

Glass bottles are a great help in the treatment of cholera. The cholera bacillus does not grow on glass. Glass is the best material for a bottle. Glass is the most inert material known to man. Glass bottles are very safe to handle. Besides, the glass industry has made considerable advances in the manufacture of glass, including improvements in lightness and strength. Glass is the most widely used container. The leading glass companies, including Ardagh, Verallia and Owens-Illinois, are investing heavily in research and development. They are developing new glass formulations and improving glass recycling technology. These developments will contribute to the industry’s efforts to meet the challenge of reducing plastic waste and promote the circular economy.

Regional Market Size

Regional Deep Dive

The glass packaging market is experiencing significant growth in several regions, driven by a growing preference for sustainable and recyclability. In North America, Europe, Asia-Pacific, the Middle East and Africa, and Latin America, the food and beverage industry, the cosmetics industry and the pharmaceutical industry are driving the demand for glass packaging. Each region has its own characteristics, based on cultural preferences, legal frameworks and economic conditions, which in turn influence the dynamics and growth potential of the glass packaging market.

Europe

- Europe is at the forefront of the glass packaging market, with stringent regulations on single-use plastics driving manufacturers to adopt glass as a preferred alternative, supported by companies like Verallia and Saint-Gobain.

- The European Union's Green Deal initiative is fostering innovation in glass recycling processes, which is expected to enhance the circular economy and increase the availability of recycled glass for packaging.

Asia Pacific

- The Asia-Pacific region is becoming more and more urbanized and the middle classes are growing. The demand for glass packaging is growing with it, and the role of Nippon Glass and Toyo Glass is increasing.

- Innovations in lightweight glass technology are gaining traction in countries like Japan and China, where manufacturers are focusing on reducing transportation costs and improving energy efficiency in production.

Latin America

- Latin America is witnessing a growing trend towards sustainable packaging, with countries like Brazil and Mexico leading the way in adopting glass packaging solutions, supported by companies like Vidraria Santa Maria.

- The region's unique cultural appreciation for artisanal and premium products is driving demand for glass packaging in the food and beverage sector, particularly in craft breweries and local distilleries.

North America

- The North American glass packaging market is witnessing a surge in demand for eco-friendly packaging solutions, with companies like Owens-Illinois and Ardagh Group leading the charge in sustainable practices and innovations.

- Recent regulatory changes in California, aimed at reducing plastic waste, have prompted beverage companies to shift towards glass packaging, significantly impacting market dynamics and encouraging investment in glass recycling technologies.

Middle East And Africa

- In the Middle East and Africa, the glass packaging market is being driven by the booming beverage industry, particularly in countries like South Africa and the UAE, where companies such as Consol Glass are expanding their production capabilities.

- Government initiatives aimed at promoting recycling and reducing environmental impact are encouraging investments in glass packaging, with several countries implementing policies to support sustainable practices.

Did You Know?

“Did you know that glass can be recycled indefinitely without losing quality or purity, making it one of the most sustainable packaging materials available?” — International Glass Recycling Association

Segmental Market Size

The glass packaging segment is a major player in the packaging market, which is experiencing stable growth due to the growing demand for sustainable and recyclable products. The growing awareness of the environment and the stricter regulations on plastic waste are the main driving forces. For example, the European Union’s ban on disposable plastics is driving manufacturers to adopt glass packaging solutions. Glass is already widely used in the beverage industry, with companies like Coca-Cola and Heineken as leaders. Glass is used in the food and beverage industries, where glass is preferred for its inertness and ability to preserve the quality of the products. These trends are further accelerated by the rise of eco-friendly packaging initiatives and the stricter government regulations on sustainable development. Glass has a long history in the packaging industry. With the introduction of lightweight glass and the development of glass recycling technology, glass has become more accessible and more appealing to manufacturers and consumers.

Future Outlook

Glass containers are to experience a strong growth from 2024 to 2032, a market value of 51.04 billion to 76.35 billion, a compound annual growth rate of 5.16%. The growth is based on the increasing demand for sustainable packaging solutions from consumers, and glass is widely known for its recyclability and low environmental impact. The glass containers are to become more and more important in the food, beverage, cosmetics and pharmaceutical industries. The glass containers could penetrate these industries up to 35% in 2032, according to forecasts from the Glass Container Institute and other market research companies. Also, the technological development and the support policy will support this growth. The innovations in the glass industry, such as lightweighting and energy-efficient production, will increase the attractiveness of glass containers by reducing costs and improving performance. The support policy is aimed at reducing plastic waste and promoting the circular economy, which will further increase the use of glass packaging solutions. Also, the growing trend towards premiumization and the popularity of craft beers will contribute to the growth as brands strive to stand out from each other through high-quality and aesthetically pleasing packages. In short, the glass packaging market is to grow strongly, driven by the combination of increased demand, technological development and policy support.

Leave a Comment